‘The Blackstone Group was little known outside Wall Street until two events in 2007 catapulted it onto the public stage: the lavish sixtieth birthday party of its CEO Steve Schwarzman and the firm’s IPO a few months later,’ wrote David Carey and John E. Morris in the book ‘King of Capital’.

Today, Blackstone occupies #1 position in the $7 trillion Alternative Assets Industry. With almost $300 billion in assets under its management (AUM), Blackstone if far ahead of #2. Blackstone’s closest competitors by assets, Carlyle, KKR and Apollo have AUM below $200 billion each.

Blackstone was started in 1985 by Mr. Schwarzman together with former Lehman Brothers Holdings Inc. chairman Peter Peterson as a mergers-advisory firm. It went public in a 2007 stock offering and the founders built a powerhouse that weathered the financial crisis successfully even as other institutions crumbled. Blackstone growth story has brought fortune to the founder, Mr. Schwarzman, and he continues to hold 20% ownership of the firm.

According to Fortune, Mr. Schwarzman tops 2014 private equity earnings list. He made a cool $690 million, more than double of $331 million made by Apollo’s Leon Black, #2 in the list. Additionally, he received $570 million in dividends during 2014, besides $86 in compensation and $34 million from investments.

Blackstone is the world’s top investment firm in private equity, real estate, debt, credit and real assets. The company also provides financial and strategic advisory services, restructuring and reorganization advisory services and fund placement services.

Blackstone invested most heavily during the period 2009-2014. In the years after the global crisis, deal valuations were more reasonable. PE Funds that made substantial investment after the financial crisis are now better placed to generate strong returns. Blackstone was one of them.

Moreover, Blackstone set its new record in other areas such as fundraising, cash invested and dividends. The Company has shown an impressive performance in almost all key parameters since the time of the public offering seven years ago.

According to the Blackstone’s Full Year and Fourth Quarter 2014 Earnings capital raised for that year totalled $56.9 billion with $19.1 billion for the fourth quarter only.

Source: Blackstone Reports Full Year and Fourth Quarter Results

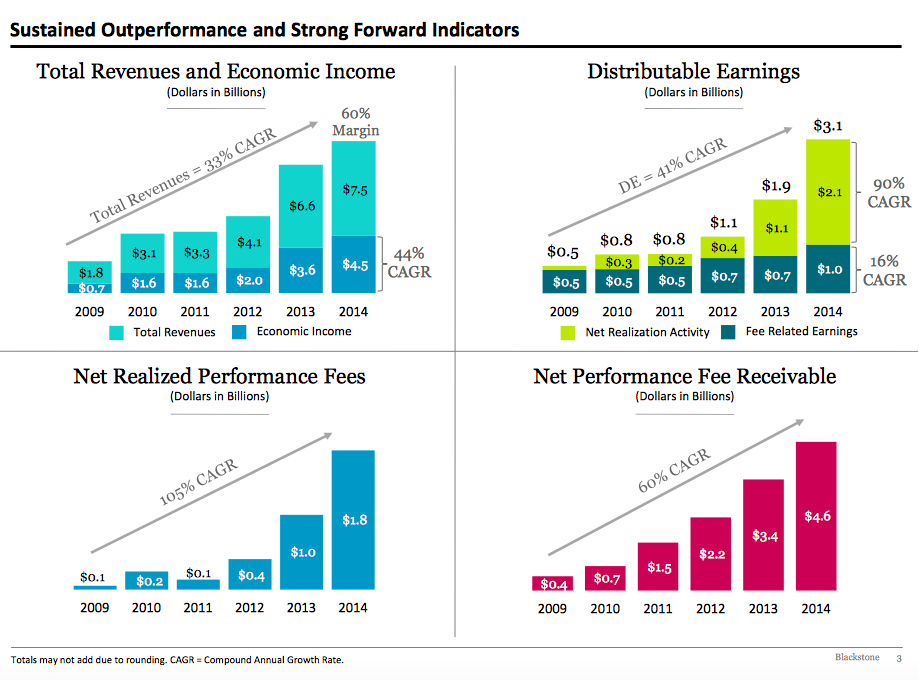

Both Economic Net Income and Distributable Earnings have recorded high CAGR above 40% in last six years, demonstrating the firm’s sustained performance and growth. As you might know, Economic net income is an industry metric that includes unrealized gains as well as cash earnings while Distributable Earnings include the net realized fees and total management fees. Last year Blackstone followed the strategy of selling assets when the valuations were at their peak. Blackstone distributed $45 billion back to its investors through realizations. Economic Net Income rose 24% and Distributable Earnings rose 64%, from $1.9 billion to $3.1 billion in 2014.

In 2014, Blackstone raised $57 billion from investors, an all-time record for any alternative asset management firm. This figure becomes even more significant as it exceeds the total funds raised by the three competitors combined. In addition, Blackstone was named “Private Equity Firm of the Year” by The Oil Council, a global network of Oil & Gas Corporate Executives.

Blackstone is also the largest real estate private equity firm with $81 billion of assets under management. Half of the firm’s unrealized investments are in the real estate area. Its real estate business continues to grow faster than other real estate firms. It was Blackstone which raised the largest Asia-focused fund and also globally largest fund in Europe in 2014. More recently, Blackstone agreed to buy Chicago’s Willis Tower- the 110-story building, the second-tallest in the U.S. Blackstone typically buys assets and improves by renovating and raising the property rental and valuation.

To conclude, like banks, Blackstone provides capital, but unlike banks, it takes control of the financed companies, improves their performance and sells them a few years later, make huge returns for the investors.

‘Looking forward, we see continued momentum across all of our businesses as the environment for both investing opportunistically and harvesting more seasoned assets remains attractive,’ assures Stephen A. Schwarzman, Chairman and CEO of Blackstone Group in a press release.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.