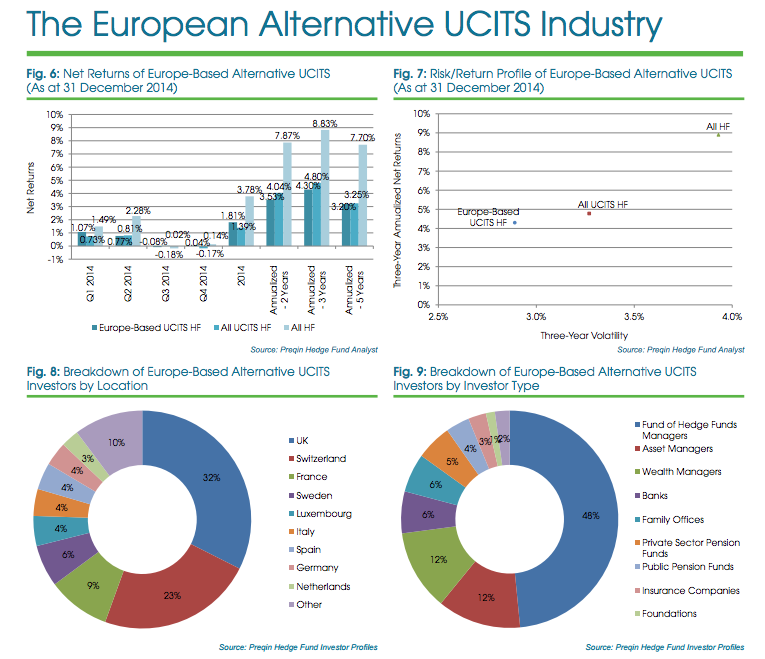

“The European alternative UCITS industry has been growing since the third iteration of the UCITS (Undertakings for Collective Investment in Transferable Securities) directive came into effect more than a decade ago and made way for alternative investment funds to be formed under the European regulated structure,” reports Preqin, a leading source of data base for the alternative assets industry.

Source: The European Alternative UCITS Industry, Preqin

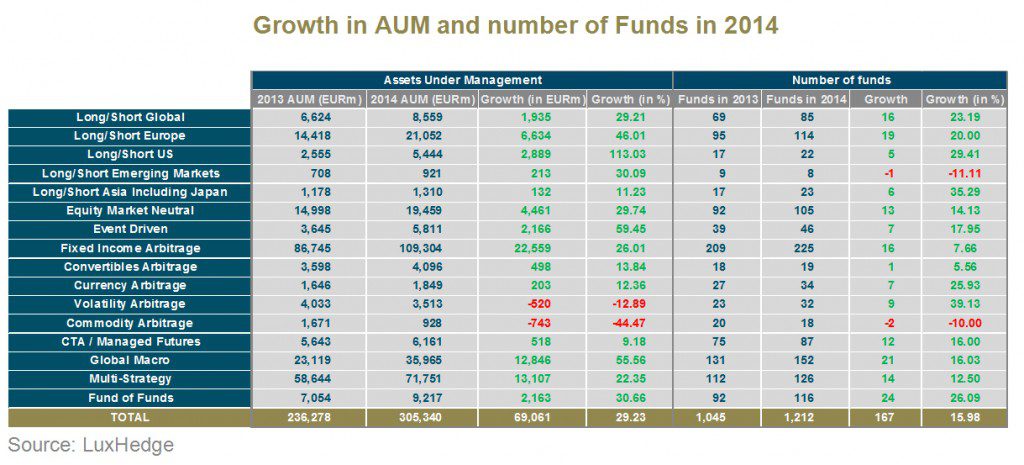

Last year was a good year for the UCITS (Undertakings for Collective Investment in Transferable Securities) funds. The assets under management under the UCITS reached 305 billion euros in 2014, a jump of 30 per cent from 235 billion euros in the previous year.

Source: Alternative UCITS Booming, AUM Up 30% In 2014

UCITS provides a single European regulatory framework for funds. These funds can be marketed in all countries in the European Union (EU). The fund and fund managers are, however, required to get registered in the originating country. The alternative UCITS is the European counterpart to the US ’40 Act open-end liquid alternative fund. The investors’ preference for the liquid alternatives such as UCITS and Act-40 funds are growing across the world as they provide opportunities to investors to invest in a liquid and regulated structure. According to a recent report, liquid alternative products are the fastest growing segment of the asset management industry.

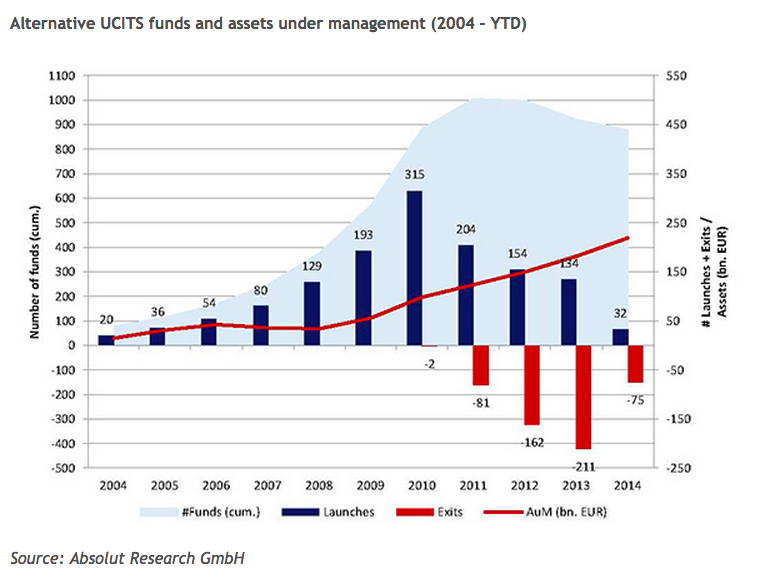

The product and management directives under UCITS framework came into effect in 2004. The directives made way for alternative investment funds to be formed under the European regulated structure. Though UCITS came into effect more than a decade ago, it became popular after the 2008 financial crisis. Investors and managers started looking at the alternatives. Investors consider UCITS-compliant funds more attractive for better regulatory supervision, transparency, liquidity and tax effectiveness.

Following the financial crisis, the market of alternative UCITS funds saw a tremendous growth, both in assets and number of funds. The assets under management by the alternative UCITS climbed from 34 billion euros in 2008 to 305 billion euros last year, a jump of nine times in six years. There has been an annualised growth at the rate of 30% in the alternative UCITS assets since the 2008 financial crisis.

Source: Alternative UCITS – A hedge fund alternative for European investors?, by Michael Busack, Managing Partner, and Jan Tille, Research, AIMA

The number of funds also expanded to over 1200, more than three times since 2008. But the investors prefer tested and large funds. This has led to consolidation. AUMs are highly concentrated; the 10 largest funds manage one third of total funds. Again there are more than 15 strategies used by Fund Managers, but most preferred one is Fixed Income Arbitrage funds with 109 billion euro, one third of total UCITS funds. Fixed Income Arbitrage funds provide portfolio diversification with better risk adjusted returns. Fixed Income Arbitrage index is the only UCITS index having delivered a positive performance each year since 2009. The next two popular strategies are Multi-Strategy and Global Macro which together account for another one third of the total UCITS funds. Multi-Strategy funds is considered as a good alternative to Fund of Funds to diversify their risk, while Global Micro provides a good exposure to exploit global events.

The AR UCITS Alternative Equity Index has delivered slightly higher returns and also lower downside risks than the HFRX Equity Hedge Index over the last 36 months and also over a longer time period beginning 2008.

A word of caution. During bull phase, the UCITS funds would generally perform lower than the average equity fund. Investors would not make money comparable to direct investments in share markets. In fact, the UCITS Funds are designed basically to protect the investments during the periods of economic uncertainties and when market is volatile and falling. The alternative investment strategies provide capital protection through active risk management techniques. During the financial crisis protection of capital matters most. In a way, investors pay some sort of insurance premium for this, they forego higher return potential during bullish periods.

To conclude, the Alternative UCITS has grown at an annualised rate of 30 % since the financial crisis. Market participants say UCITS products are still in infancy and this growth is likely to continue. The Alternative UCITS provide investors good opportunities for reasonable returns with some capital protection during the periods of volatile markets and downfalls. And the managers get a chance to design their strategies suitable to explore and exploit this fastest growing sector of the Alternative Assets Industry sector.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.