The Directions for the Hedge Fund Industry – Opportunity(ies) in the face of adversity, innovation, regulation and Disruption! #Gaim2015

Are Hedge Funds managing close to 5% of the assets of the global economy? Bearing in mind that most of Hedge fund managers forecast that industry assets under management (AUM) are set to increase and surpass the figure of $3.02tn (reported in December 2014 but reinforced in 2015 by Preqin and Deutsche Bank) the percentage is significant. So what are the directions for hedge funds, alternative investors in an industry going through an unstoppable stream of growth, adversity and of course opportunities?

If the size of the world economy that is Nominal is $77.609 trillion (2014 est.) and PPP: $106.998 trillion (2014 est. Source Wikipedia global data) the quantity of AUM managed by Hedge funds is significant, an amount for an industry still very young and under a lot of question marks.

In the last 3 days Gaim 2015 – the leading Hedge Fund, Alternative Investment Conference industry in Monaco – offered a privilege stage for global industry professionals to discuss the overal state and directions for the industry. Gaim one of the 2 biggest conferences in the world attracted 400 delegates, including fund managers, investors, family offices, legal firms, offshore financial players, locations and service providers.

Industry leaders and personalities such as Simon Thorp, Senior Portfolio Manager Credit Long/Short KKR, Juan Antolin-Diaz, Economist at Fulcrum Asset Management, Morris Mark, President of Mark Asset Management, Tolga Uzuner, Partner, Emerging markets Apollo, Roy Niederhoffer, president of RG Niederhoffer, Chuck Clough, Chairman & CEO Clough Capital Partners, Don Steinbrugge, Chairman, AGECROFT Partners, Caspar Berry, Serial Risk Taker, Poker Ace & Psychologist, John Hulsman, Geopolitical Expert & Life Member, US Council on Foreign RelationsL, D Dixon Boardman, Founder & CEO, OPTIMA among many other discussed and highlighted in engaging debates the state and direction(s) of the hedge fund alternative industy with the Gaim community.

The state and direction(s) of the hedge fund alternative industry – Highlights!

There’s little doubt that hedge fund industry is a fast changing and maturing industry. With all the changes in markets and new additional regulation in place Institutional investor capital will nevertheless continue to flow into the hedge fund industry in 2015. The trend is for a concentration of the assets in the top 100 Hedge Funds but startup hedge funds and new innovative platforms for sure will find new ways to create their own footprint.

The competitive forces now shaping the alternative investment industry so far closed and quiet secretive are changing as the industry fast grows and requires more infrastructure and legal requirements. The overall industry, and special assets under management will be disrupted further.

We’ve highlighted the main various trends and hot topics have to be put in consideration and appear poised to drive and in same case offer opportunities for new growth in hedge fund industry:

- Increased need for regulatory and compliance reporting;

- Increase need for infrastructure and business development;

- Manager and product further alignments and convergence;

- Cost-efficient flexible and differentiated fee operations;

- Expanded outsourcing of operations or investment of in house infrastructure;

- Fintech increasing set up requirements and technology infrastructure;

- Liquidity different approaches but important as a basis for business;

- Algorithm and artificial intelligence will be critical for the future of the hedge fund industry and will disrupt it further.

HedgeThink highlight of the best Tweets and Insights by the conference players:

The HedgeThink team highlighted some of the best insights, tweets and ideas by some of the best digital protagonists:

On Multi strategy for Hedge Funds

Hamlin @hamlin74 15 hrs15 hours ago

Multi strategy hedge funds use more leverage than funds of funds today – PAAMCO #gaim2015

The new challanges and opportunities of algorithm and artificial intelligence for the hedge fund industry:

Automated Trader @automatedtrader 16 hrs16 hours ago

Quant and systematic panel coming up at #gaim2015. Now that Bridgewater is going into machine learning, hedge funds paying more attention

Markus Schuller @panthera_s Jun 23Monaco

Interesting: Jeroen Tielman from @Imqubator expects “1 and 10” to become the floor in terms of HF fees. #gaim2015 @GAIM_Intl

Automated Trader @automatedtrader 15 hrs15 hours ago

Investors should allocate to diversified strategies, not diversified firms – Systematic Alpha’s

Peter Kambolin #gaim2015Automated Trader @automatedtrader 16 hrs16 hours ago

QuantBridge’s AI systems show a shift in holding periods for markets covered, self-generating rules moving to trend following #gaim2015

Risks for the industry:

Ajay Bagga @Ajay_Bagga Jun 23

Calculated risks means losing money short term but making money long term. Great leaders take risks – Poker Ace Caspar Berry at #gaim2015

Eleanor Bates @EllieLaverty Jun 22

The risk – free investment is a return – free investment says sovereign investor Dr Rania Azmi at #gaim2015

Ajay Bagga @Ajay_Bagga Jun 23

The risk – free investment is a return – free investment says sovereign investor Dr Rania Azmi at #gaim2015

Markus Schuller @panthera_s Jun 22Monaco

Rania Azmi: “Risk free assets no longer exist, if they ever did.” Correct conclusion. #gaim2015 #Monaco #SWF

Liquidity:

Ajay Bagga @Ajay_Bagga Jun 23

Michiel Meeuwisen (Kempen, FoHF): the biggest risk in the markets at the moment is illiquidity in credit markets #gaim2015

Markus Schuller @panthera_s Jun 22Monaco

R. Murray #Graham Capital Mgmt: “#LiquidAlts are equally attractive for institutional & retail investors.” #gaim2015

Real assets:

Eleanor Bates @EllieLaverty Jun 22

Real assets amongst the most volatile. Due diligence crucial say our intrepid investors in Investor Quest #gaim2015

What Investors are looking for:

Benjamin Ball @BenjaminBallA Jun 22

What investors look for: Sourav Sengupta of AIG looks for fund managers who really understand their circle of excellence. #gaim2015

Our HedgeThink overall main highlights:

Hedge Fund DNA @HedgeThink Jun 23

#Gaim2015 #ethics and #integrity critical for the growth of the #hedgefund industry but challenging and complex landscape.. Peter Coates

Hedge Fund DNA @HedgeThink Jun 23

#Gaim2015 there is not one view fits all in investment and #hedgefund industry. Investors are diversifying. #Liquidity comes at a price.

Ajay Bagga @Ajay_Bagga Jun 23

Risk free assets no longer exist, if they ever did.” Correct conclusion. #gaim2015 #Monaco #SWF

Automated Trader @automatedtrader 17 hrs17 hours ago

It’s not diversification that fails, it’s bad attempts at diversification that fail, says Pepperdine University’s Michael Nicks at #gaim2015

Ajay Bagga @Ajay_Bagga Jun 23

The risk – free investment is a return – free investment says sovereign investor Dr Rania Azmi at #gaim2015

Automated Trader @automatedtrader 18 hrs18 hours ago

Specificity is key, hedge funds should be prepared to disclose everything they do says Mark Asset Management pres Morris Mark at #gaim2015

Hedge Fund DNA @HedgeThink Jun 23

#MIFID 2 + changes coming that will be game changing. compliance officers will have to monitor changes Anna Maleva-Otto #hedgefund #Gaim2015

Hedge Fund DNA @HedgeThink Jun 23

#gaim2015 “2014 was the best year for sales of #hedgefunds. More pain but more game.” William Jones #regulation but pressure to diversify.

Hedge Fund DNA @HedgeThink Jun 23

#Gaim2015 regulators not complying with each other. Key fund jurisdictions with contradictions. #hedgefund

Hedge Fund DNA @HedgeThink Jun 23

#Gaim2015 #algorithmtrading and #HFT will be under increasing surveilance by regulators and #compliance. Anna Maleva-Otto #hedgefund

Hedge Fund DNA @HedgeThink Jun 23

#Gaim2015 Rob Mastrodomenico crunches sports #data statistics parameters Parallels with #hedgefund algorithm trading

Summary – Growth, regulation and further opportunities in the face of adversity

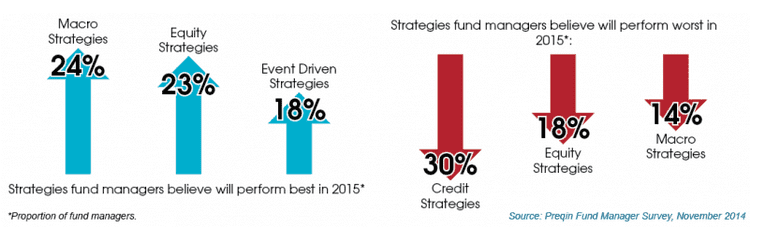

To synthetise Hedge fund managers forecast that industry assets under management (AUM) are set to increase this year, and surpass the figure of $3.02tn reported previously in December 2014 in . Indeed, 63% of surveyed fund managers have a positive outlook on the hedge fund industry in 2015, despite questions raised following CalPERS’ exit and poor industry performance in 2014 (that still showed nevertheless a substantial growth and the best year so far for the industry. A small but not insignificant proportion (26%) of institutional investors intend to increase their hedge fund allocations in 2015, and a larger proportion (40%) of investment consultants will recommend their clients increase their allocations to hedge funds in 2015.

Strategies used by hedge fund managers graphic, source Preqin survey

As over 80% of hedge fund AUM is already administered by a third party fund admnistrators, legal firms and consultants will have new opportunities to manage all the backstage operations for the industry. But as both organic and inorganic Hedge Fund growth opportunities decrease, there will be new demand for infrastructure and administration services and special for increasing compliance and legal focus and investment.

So and despite producing only an average not so fantastic return of 3.3 percent last year, the hedge fund industry is on track for growth, surpassing $3 trillion in assets this year, even with less expectation on returns, according to also the new 2015 survey by Deutsche Bank. The opportunity is there independent of the size of the face of adversity and the crowded trade.

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.