How Can Twitter and Google predict the stock markets? Advanced Insights based in a research sponsored by the ECB.

Market sentiment is going to be more and more a real time social media game. Twitter and Google are ta the moment the most powerful digital players adding to the big complex set up of financial and capital markets with its data velocity and algorithm / sentiment driven capacity of aggregation and leveraging big amounts of data.

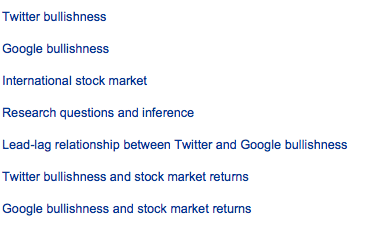

In the first part 1 of this article Can Twitter and Google predict the stock markets? The ECB thinks so! Part 1 we started examining a study carried out by the European Central Bank which investigated whether Twitter and Google can predict the stock markets. The research study can be found in this PDF here: Quantifying the effects of online bullishness on international financial markets. In Part 2 we will now move on to look in greater depth at some important aspects of the study, including the lead-lag relationship between Twitter and Google bullishness. We will also look in greater depth at Twitter bullishness and stock market returns as well as Google bullishness and stock market returns.

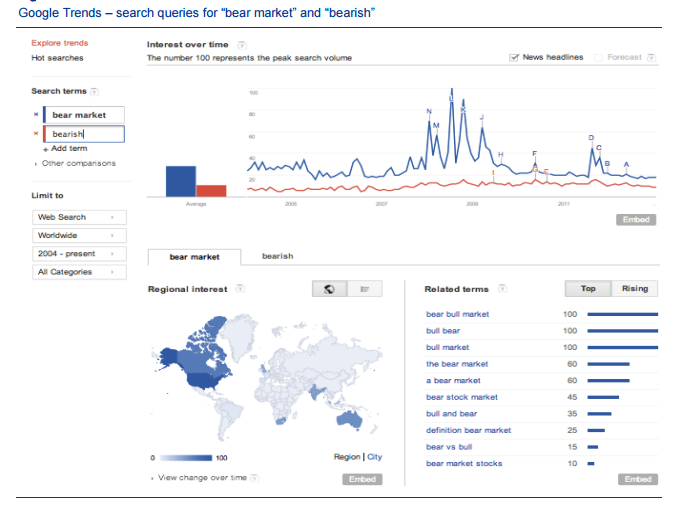

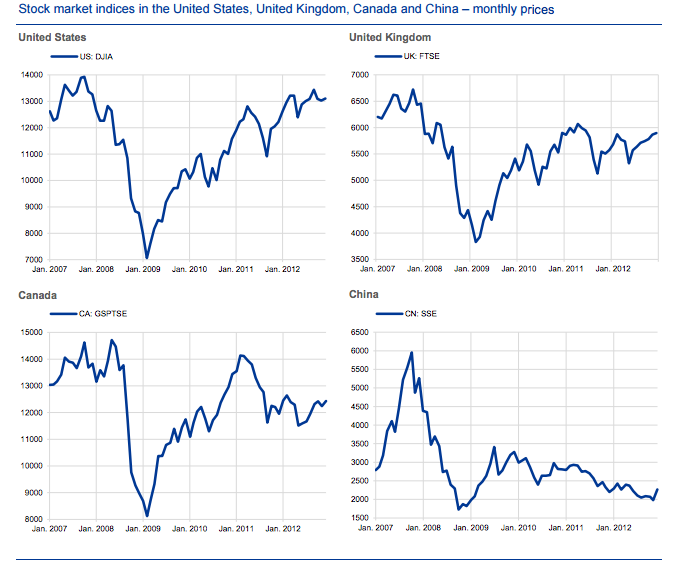

This insightful research, probably the most influential done by researchers in the financial / investment world uses and data mines a Twitter dataset that is mainly acquired via Twitter Gardenhose, which consists of a random sample of public tweets (about 45 million tweets per day) during the period January 2010 to December 2012. It uses as well Google search query data were retrieved from Google Trends (http://www.google.com/trends/) in 2012; this provides weekly search volume data on all queries made after January 2004.

The values used for the study were dynamically scaled to the range of [0, 100], between volume peaks and troughs. Data from two investor sentiment surveys, the Daily Sentiment Index ) and the US Advisors’ Sentiment Report of Investors Intelligence (http://www.investorsintelligence.com/x/us_advisors_sentiment.html)

were kindly made available to the authors. All historical market data used in the research were retrieved from Yahoo Finance! ) in 2012.

Reviewing the lead lag relationship between Twitter and Google bullishness over time, the research team sought to understand whether these factors were linked or if when lead or lagged another. In undertaking this work it was found that Google bullishness figures are captured weekly, while Twitter bullishness is captured on a daily time series. This made it tricky to compare the two.

The way that this was done was by calculating the weekly mean of Twitter bullishness. As a result of this and of the researchers applying statistical analysis it was determined that there was a “positive and statistically significant correlation between Twitter bullishness and Google bullishness. To understand which direction this worked in the researchers looked in both directions and did an autoregression analysis.

Twitter bullishness has a statistically significant and positive influence on the change in Google bullishness!

The analysis showed the researchers that Twitter bullishness has a statistically significant and positive influence on the change in Google bullishness over the course of the following week. Additionally the analysis led the researchers to believe that Twitter bullishness leads Google bullishness, but the pattern does not occur the other way around. This means that Twitter has an advantage on Google search, but more research is needed to validate this area clearly.

Moving on to Twitter bullishness and stock market returns

Moving on to Twitter bullishness and stock market returns, and considering that Twitter bullishness was found to lead Google bullishness, the VAR model was used to see if Twitter bullishness predicts stock market returns. The US stock market was reviewed, mainly due to its large size, and because the USA has the biggest number of Twitter users worldwide.

Various indices were used in the study such as the DJIA, the S&P 500 and the Russel 3000 index. The Twitter bullishness prediction was checked against all of these major US stock indices. As a result it was indicated that Twitter bullishness on the previous day has both statistically and economically significant results for all of the different indices tested. This result was found to be consistent with the model on investor sentiment produced by De Long et al. in 1990.

The predictive value of bullishness was also tested on the other three countries of the study. Very similar results were found for Canada and the UK to the US results. In the Chinese market, as one might expect given the relative lack of use of the tool, Twitter bullishness was found to have a significantly lower predictive value.

Reviewing Google bullishness and stock market returns.

Reviewing Google bullishness and stock market returns, a positive relationship was found between Google bullishness and index price levels. The bullishness was seen to lead the latter. This finding was found to hold true particularly strongly in situations of extreme market conditions. However, correlations found between Google bullishness and stock market prices do not help in determining which of the two drives the other.

This meant that the researchers had to use regression analysis to see the level at which Google bullishness on a weekly basis can impact market returns. The level and change of Google bullishness were not found to predict the weekly returns of some of the indices such as Dow Jones, FTSE 100, GSPTSE and SSE.

The researchers attributed this finding to the fact that Google Trends information was only available on a weekly basis. This made it difficult to unearth to the right level of detail whether Google bullishness has the anticipated impact that the researchers expected to see.

Conclusion and how social media – twitter and Google (for now) wil become even more important for markets and investors!

To conclude results the research support the investor sentiment theory (De Long et al., 1990a), and suggest that Twitter bullishness may provide a useful and simple investor sentiment index.

The majority of tradeable news stories concern things like profit warnings, growth forecasts, or policy decisions, and if you’re hearing about these via social media, it’s highly unlikely that you’ll be among the first to do so. However, the one thing that you can take from social media that isn’t available more reliably or quickly via other channels is the way in which people are reacting to events.

In many ways, this is more valuable than the announcements themselves, as it can act as a barometer of mass sentiment, and offer clues as to how the market might react in the longer term. The main issue with this is that you are limited by the accounts that you have chosen to follow and the amount of data that you can view at any one time. Market sentiment is a big-picture phenomenon, and trying to gauge it by viewing individual posts is the equivalent of looking at a map with a microscope.

This is where data mining comes in. This is an emerging technology that uses large-scale cloud computing power to analyse data resources that are too vast for a human to efficiently sift through, such as that produced by social media. The information produced by this process can then, in theory, be leveraged to help inform trading decisions based on market sentiment, and this is a theory that is gaining credibility by the day.

The first high-profile case of this approach came in early 2011, when Derwent Capital started a fund using the analysis of Twitter sentiment data to trade large stock indices. The fund made a 1.85% return during its first and only month of trading, after which it was wound down due to a lack of interest from investors. But while it wasn’t a complete success, it did at least establish the idea that social media sentiment could be used to drive profitable trading and investment decisions.

The speed and accuracy of social media sentiment analysis presents barriers to predicting stock price movement. Another concern for finance professionals is the accuracy of data, which respondents believe could prevent the use of sentiment analysis from achieving mainstream adoption.

Dr Daniel Beunza, Lecturer in Management for the London School of Economics (LSE), said that while sentiment analysis presented was an “interesting concept” for traders, its full potential had not yet been reached. Perhaps.. nevertheless NYSE Tech has spotted opportunity.

Savvy industry participants, hedge fund managers are already using NYSE Technologies’ market data feeds such as SuperFeed and SFTI network to get social media market sentiment statistics, following a deal between NYSE and specialist company Social Market Analytics. Given the rising importance of social media sentiment its no wonder the entire financial and capital markets industry will have to take this into consideration and work side by side with their general social media strategies an additional and more powerful layer of social media trading reporting and sentiment analysis for markets and investors.

Another interesting study to look and add to this discussion is this: Data Mining Methods in Twitter, by Wendi Zhu, Presented at Data Science MD March 17, 2015

All of this provides interesting food for thought for traders. It will be interesting to see if additional studies are carried out that mirror these findings, or show them to be the case in other countries as well in the future.

Article written with Paula Newton

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.