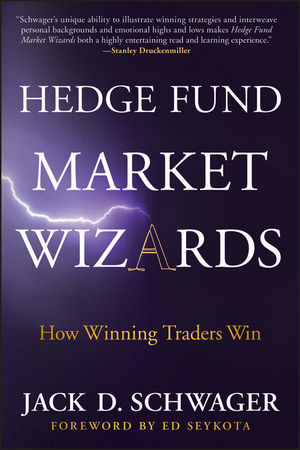

Jack D. Schwager’s Market Wizards series of books are among the most widely read books on the topics of trading and investing, full of invaluable tips for anyone who is thinking of trading the markets, or investing in those who do. The fourth in the series, Hedge Fund Market Wizards, is like its predecessors composed of interviews with some of the leading authorities on trading and the markets, in this case some of the most successful hedge fund managers of all time including Ray Dalio, Joel Greenblatt, and Edward Thorp.

In the following interview with Opalesque TV, author Jack D. Schwager talks about his approach to the books, the changes in the market between the publication of the first Market Wizards book and the latest, and expounds on some of the conclusions that he has drawn from interviewing top hedge fund managers. These are, of course, immensely useful from an inspiration point of view for anyone that is actively involved in trading, but also serve to educate investors in what they might want to look for in a hedge fund, and how they go about achieving their goals in terms of returns.

1: Find your own style

Above all else, Jack Schwager emphasises the need to find a trading style that suits your personality. For example, it is no use trying to learn about trading under a day trader when your personality and talents are better suited to a more long-term approach based on market swings, and if you were to go to work for that trader, you would struggle to realise your full potential. There are many successful approaches to trading at a hedge fund – the one uniting factor amongst all of them is that the most successful traders in that style chose it because it was a good match for their temperament, pace, concentration levels, and other natural aptitudes.

2: Be flexible

Another key takeaway from the book is that traders need to be flexible in their approach, tailoring it to the market conditions at the time rather than waiting for the market to behave the way they expected it to. In order to succeed in trading, you need to be ready, willing, and able to change your mind when the market teaches you a lesson. “Good traders liquidate when they are wrong” says Schwager. “Great traders reverse when they are wrong”.

3: Volatility does not equal risk

Over the decades, market volatility has become equated in the public imagination with increased risk, but while this can be true when pursuing certain investment strategies, it is not true on the whole. In many cases, volatility is what provides a trader with oppportunities to make profits, and there are often greater risks to be found in range-bound markets than there are in highly volatile ones.

For example, in a low-volatility market such as out-of-the-money options, returns can seem for the most part steady and predictable. However, if there is a sudden dip in the market, it can be catastrophic for those who have been following a slow and steady approach that does not take into account the occasional ‘hurricane’, and this is an example of how low volatility can mean high risk. He likens it to walking through a minefield with very few mines in it – until you step on a mine, it seems very low-risk.

Conversely, you can have strategies that have a high volatility with a very low risk. For example, if you have a strategy that occasionally makes big profits, and employs a risk management strategy to reduce downside risk, then most of the volatility is on the upside – and therefore the risk associated with that strategy might be fairly low.

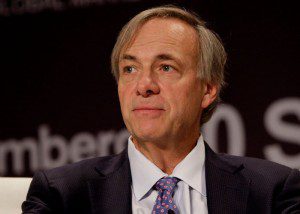

4: Lessons from Ray Dalio of Bridgewater Associates

Hedge fund legend Ray Dalio has the world’s biggest hedge fund company, and over the years has managed to make consistently outsized returns that do not bear any correlation to the movements of the markets. The key to this success, Schwager states, has been his enthusiasm for diversification and his refusal to use correlations to inform these choices. Instead, he looks at the underlying factors that are driving asset prices at any given time, and tailors his approach to these rather than historical correlations, which can change at any time. By looking for markets that have different drivers, he can achieve diversification by making truly un-correlated trades. By leveraging the huge resources at his disposal, his firm are able to do deep research into the behaviour of every single market, and operate confidently in all of them.

5: Breaking all the rules – Jimmy Balodimas

Although he is not strictly a hedge fund manager, proprietary trader Jimmy Balodimas has a successful style that shows that you do not necessarily need to follow the established rules in order to succeed, and that in fact you can be quite successful if you simply tear up the rule book – as long as you know what you are doing. In Schwager’s words, Balodimas “breaks all the rules” – he doesn’t use stops, he sells during big rallies, and a lot of the time he is simply wrong in the market. Yet, he consistently makes blockbusting returns for his company by trading around the positions, so that even if he is wrong he will make money or at least break even. Key to succeeding with this type of flexible approach is his complete lack of emotionality when it comes to trading – he sees the market purely analytically, and this enables him to be able to stick to his guns or change his mind in situations where emotion would get the better of a more emotional trader.

6: Joel Greenblatt: Why value investing still works

Having made his name as an event-driven investor, Joel Greenblatt made so much money for his investors that he had to close the fund down, simply because it had grown to a size that was too big to pursue the same types of opportunities. He then moved into value investing, a strategy that was more compatible with having a larger amount of assets under management. The key to his success with this can be summarised by the following philosophy – value investing works, but not all of the time, and that is why it continues to work. If value investing worked all of the time, then everyone would be doing it and the increased competition would mean that there was little or no money to be made from it.

For example, during the bursting of the tech bubble in 1999-2000, value investing strategies performed very poorly indeed, and that scared off many traders and investors, but ensured that when long-term value positions eventually came good, they did so at a much bigger profit due to the prior lack of interest in those stocks. However, in order for this strategy to succeed, you need to take a very long-term view, and you need to be sure that you have done the right research into the fundamentals that are underpinning the stock picks.

You can find out in more detail about these insights, as well as countless others, in Jack D. Schwager’s 2012 book Hedge Fund Market Wizards, published by Wiley Finance.

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.