by Fidan Aliyeva

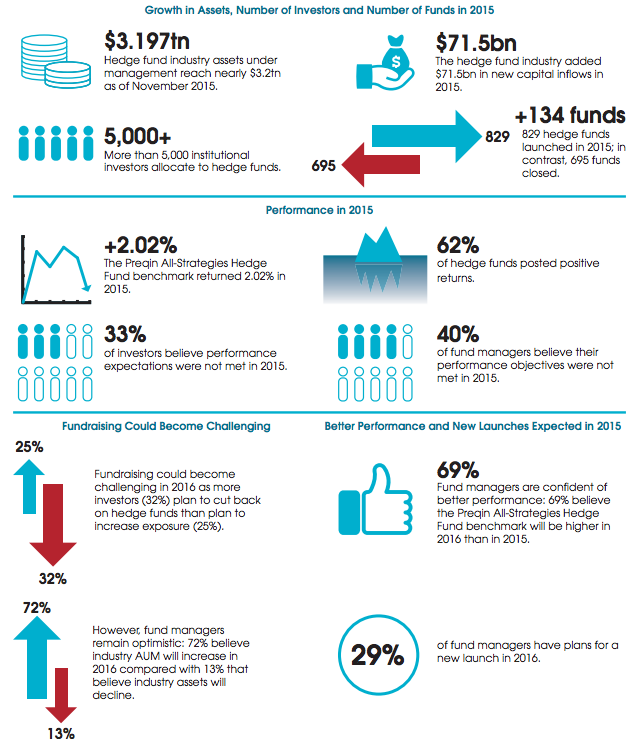

It is a well known fact that 2015 was not a successful year for hedge funds, especially from June to September when losses hit the levels of 2008. As reported by Preqin, hedge funds returned only 2.02% – the record of the worst performance since 2011 as per Preqin All-Strategies Hedge Fund benchmark.

Although, not for all hedge funds 2015 was a challenging year. As reported by LCH Investment, some top 20 managers made $15billion net of fees for their investors in 2015. But we will discuss this in our next post, while now I would like to focus on key findings that form external ecosystem for the hedge funds.

As reported by Preqin, despite of difficulties of 2015, there was a net capital inflows of $71.5bn, what raised size of hedge fund industry to nearly $3.2tn.

What’s in 2016 for Hedge Funds?

- Capital Inflows: less capital investment in 2016 vs. 2015

- Performance: a key to success in 2016. Which, according to historical records, will affect directly management and performance fees, what will add additional pressure on hedge fund managers. Am obstacle is volatile economic environment.

- Transparency: in order to better understand the source of the hedge fund performance.

- Diversificiation: It is necessary revise the portfolio as change of regulation brought in alternative structures in hedge funds. This trend leads to a growing asset base with a variety of investors.

Restructuring alternative investment industry.

According to WEF, there are three main factors that undergoing significant change and affect the structure of todays’ alternative investment industry.

- Regulation

- Insitutionalization

- Reailization

1. Regulation

Regulational changes stem from the need to protect and create risk-averse financial system after the financial crisis. As a result, the focal issue is transparency that transforms this industry from being slightly regulated to well-regulated. The institutions that underwent the regulatory changes are Foreign Account Tax Compliance Act (FATCA) (US), the Retail Distribution Review (RDR) (UK), Undertakings for Collective Investment in Transferable Securities (UCITS V), MiFID II, EMIR, Packaged Retail Investment Products (PRIPS) and Alternative Investment Fund Managers Directive (AIFMD) in the EU.

Pros and Cons

There are, obviously, pros and cons from these changes. As discussed above, transparency enforced through regulatory changes will allow to build trust and move towards greater openness between investing institutions and alternative investment firms.

Disadvantage is that these changes create costs of establishing and maintaining such a system. This will lead to

1) the increased costs that might reduce returns

2) create a barrier for new companies

3) could advantage existing leaders and drive consolidation in the industry

4) reduces innovation in the industry, what in turn affects long-term returns.

2 & 3. Institutionalization vs. Reutilisation

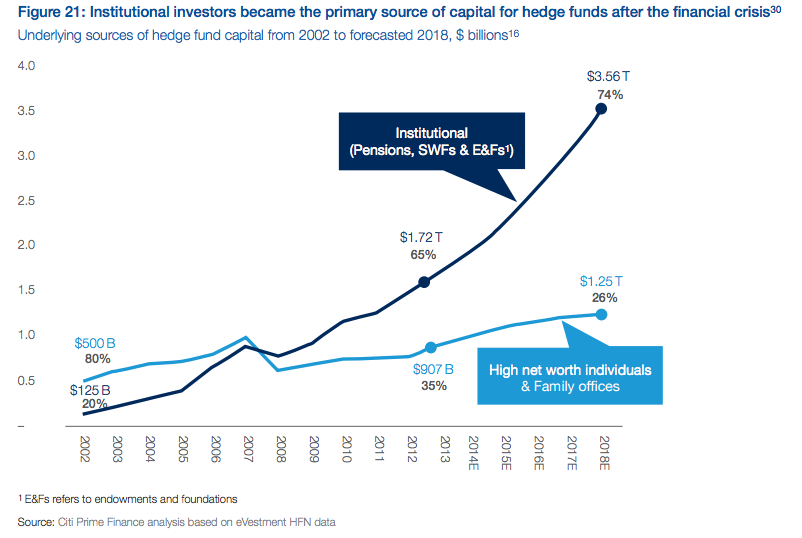

Maturity of alternative investment industry, its growing scale and experience played a significant role in building relations with institutional investors. This increased the growing scale of institutional investment in alternatives considerably.

Although the rise of retail investors is not as advanced as that of institutionalisation, the rising need of pensioners to boost returns from pension savings have already substantially increased retail investor demand for alternative assets. As a result, reutilisation is likely to lead to large inflows of capital into alternative investment industry over the next decade.

How will future landscape look like?

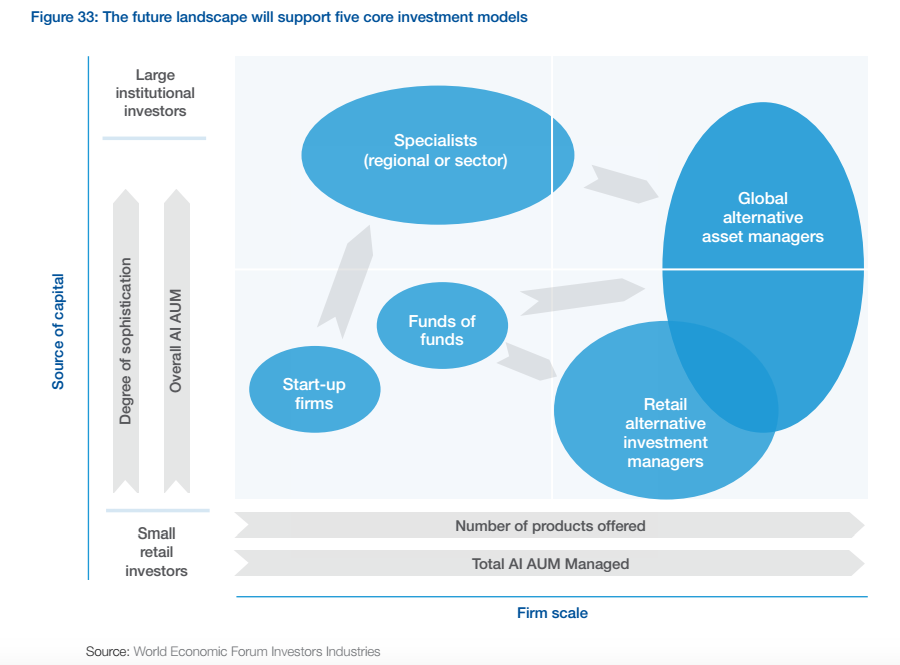

As mentioned above alternative industry will face a new challenge. Industry will undergo changes not only from the regulatory part, but also from new levels of trust and transparency. As a result, new business models will be raised as well as new relationships with the rising impact of retailization.

Below are five core models that will create industry landscape in the next decade or so. In the brackets, there are companies that are already implementing new strategy.

- global alternative asset managers (KKR, The Blackstone Group, Apollo Global Management, the Carlyle Group already employing this strategy).

- specialists (regional or sectoral) (ex. Silver Lake Partners, Providence Equity Partners, The Abraaj Group and Actisi).

- retail alternative investment managers (BlackRock, Affiliated Managers, Invest, Franklin Resources, AllianceBernstein)

- start-up firms and

- funds of funds.

While all the segments are doing quite well and will attract more investments through changed strategy, the market share of funds of funds will reduce significantly. As per Russell survey, only 17% of investors plan on using hedge funds of funds over the next three years. The main reason is the growing familiarity of institutional LPs with alternative investing due to their ability to invest directly with their preferred GPs without paying another layer in management costs.

Conclusion

Different layers of relationship becoming more critical for hedge funds to survive in this changing macro-environment. The pressure form curious investors who would like capital flow and returns to become more transparent, as well as interest from regulators and policy makers creates an additional pressure on hedge fund managers. However, considering the fact that alternative investment industry benefits the wider society and world economy, supporting long-term, risk investments of a kind, hedge funds serve as an important source of liquidity for financial markets. Therefore, it is critical to create a friendly environment for transitions to be implemented more smoothly from regulatory viewpoint, while acceptance of flexible strategical structure introducing one of the new core models, might be a guarantee of success for hedge funds.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals