Within minutes after the opening bell on Black Monday, August 24, the Dow plummeted 1,089 points, surpassing even the flash crash of 2010. Dramatic declines caused stocks and exchange-traded funds to be automatically halted by stock exchanges more than 1,200 times. The market remained volatile in next weeks also, pulling down both the Dow and the S&P 500 indices down by more than 6 percent in August.

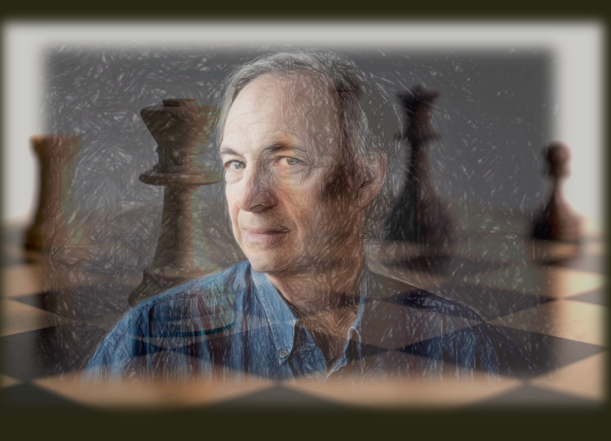

The risk parity strategy, pioneered by Ray Dalio, the founder of world’s largest hedge fund, came under fire for this market volatility. The risk parity investment strategy was developed and first adopted as All Weather Fund in Bridgewater Associates in 1996 and has become increasingly popular in the industry. This has been one of most successful investment strategies since last two decades.

But its recent performance has been poor. Of late some analysts and fund managers such as Lee Cooperman of Omega Advisors have started blaming the risk parity strategy for the market turmoil seen in recent weeks. This pushed Dalio to a defensive position, prompting his firm to come out with a report for its clients defending his risk parity approach. The Bridgewater report tries to dispel many of the concerns surrounding risk parity and the All Weather fund.

Let us see what this risk parity strategy is, how it works, what blames are and what Dalio wants to say.

What is All Weather risk-parity strategy and how does it work?

The risk- parity strategy is Bridgewater’s flagship strategy, known as All Weather strategy. It is one of the two investing strategies consistently followed since last two decades by Bridgewater Associates, the world’s largest hedge fund with $170bn in assets under management.

While the Bridgewater’s other strategy, known as Pure Alpha, is a traditional hedge fund strategy, All Weather is a risk-parity and leveraged beta strategy. It is based on the philosophy that there are four basic economic scenarios: rising or falling growth, rising or falling inflation. And different class of assets behave differently in each of these economic scenarios. The risk-parity’s objective is to reduce the volatility of investing in assets that normally move in the opposite direction in different economic environment. The All Weather strategy allocates 25% of a portfolio’s risk to each of these scenarios. It is allocation of risk and is different from allocation of assets.

The portfolio makes money in any economic environment and is considered as a solid strategy in both good and bad markets. All Weather has given 8.95 percent average annual return since its inception in 1996. Its long-term success has helped the industry expand. But this August, $80bn “All-Weather” risk parity fund lost 4.2 per cent and is down nearly 5% YTD. The famous all weather strategy is facing rough weather from critics.

What are blames on the risk parity strategy?

First, the risk parity strategy allocates assets based on volatility. The ‘smart beta’ passive equity strategies adjust their exposures according to algorithms in response to market moves. The risk parity funds and momentum investors known as CTAs are typically computer driven. Any in volatility can trigger a rash of automated selling.

Second, the risk parity strategy involves use of leverage, derivatives and borrowed money, to amplify their bets tied to the performance of bonds, stocks and commodities. Fund Managers often shift their allocations of assets to maintain an equal distribution of risk. They invest passively in a range of financial assets according to their mathematical volatility.

In August as volatility increased, these funds are accused to have begun selling with increased intensity. The selling created more selling. This effect then cascaded through markets, and asset correlations increased. As a result assets like stocks and bonds, which often trade in opposite directions, began to fall at the same time. Market collapsed. The risk parity strategy too underperformed.

What does Ray Dalio say in defense of risk parity strategy?

The inventor of risk parity strategy, Ray Dalio, strongly defends his strategy and Bridgewater’s approach amid criticism. While the strategy might occasionally underperform other investment techniques, but it was still the best long-term strategy. Unlike other funds, Bridgewater does not tend to sell assets when prices fall and buy them when prices rise. It does the opposite to rebalance to achieve a constant strategic asset allocation mix. All Weather portfolio is well diversified so as not to be exposed to any particular economic environment. It has no such systematic bias to do better when interest rates are falling compared to that when they are rising. So it is not vulnerable to a bond sell-off.

Dalio says Bridgewater is not responsible for the stock market increased volatility seen last month. Relative to the size of global asset markets, the risk parity strategy funds is too small to move market. It is like a drop in the bucket. Allocations are not adjusted due to swings in volatility, and therefore could not have created the market impact.

“All Weather is a strategic asset allocation mix, not an active strategy. As such, All Weather tends to rebalance that mix which leads us to tend to buy those assets that go down in relation to those that went up so that we keep the allocations to them constant. This behavior would tend to smooth market movements rather than to exacerbate them,” fires back Dalio in the Bridgewater Report.

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.