This is the last part of the series on Financial regulation and the Hedge Fund Industry which gives an overview of the main regulatory bodies within the industry. The first part focused on hedge fund strategy while Part 2 – on market transformation.

Among the many other requirements that will be imposed on regulated entities and how and where they must execute their swaps and security-based swaps with hedge funds and other counterparties, the new regulatory regime under Title VII of Dodd-Frank will require that most derivatives contracts formerly traded exclusively in the OTC market be subject to “central clearing”. Central clearing uses a clearing agency to act as a central counterparty to remove individual counterparty credit risk and distribute risk among the clearing agency’s participants that must satisfy the clearing agency’s capital and margin requirements. Moving most privately negotiated, bilateral contracts in the OTC market to central clearing and requiring real-time trade reporting would allow the regulators to see the volume of contracts trading in the market, to assess the asset classes in play, to monitor derivatives trading data and thus, to oversee risk exposures and reduce systemic risk in the derivatives markets. These new mandates would also give hedge funds and other investors access to timely information on price and other derivatives trading data.

European lawmakers have also undertaken regulatory changes affecting hedge funds in recent years. In 2010 the European Union (EU) approved the Directive on Alternative Investment Fund Managers (AIFMD), the first EU directive focused specifically on alternative investment fund managers. AIFMD requires hedge funds to register with national regulators and increases disclosure requirements and frequency for fund managers operating in the EU. Furthermore, the directive increases capital requirements for hedge funds and places further restrictions on leverage utilized by the funds. The AIFMD requires EU-based managers to comply with all provisions of the AIFMD, while non-EU managers marketing funds in the EU are subject to reporting requirements under an enhanced national private placement regime until they are eligible to or required to market under an EU passport in the future, at which point those non-EU managers are subject to all of the provisions in the AIFMD. EU member countries are required to adopt the AIFMD into their own national legislation since 2013. The European Securities and Markets Authority and the European Commission are developing implementing rules and guidance to give effect to the AIFMD.

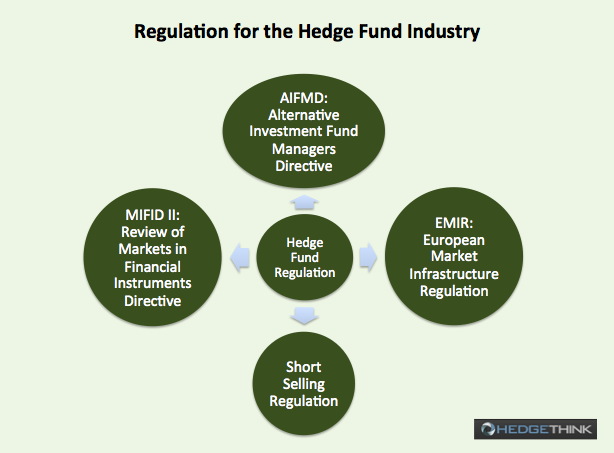

There are a number of regulations in the EU that are of specific interest to hedge funds:

1) AIFMD: alternative investment fund managers directive:

As we saw, AIFMD aims at creating a comprehensive regulatory framework for European Alternative Investment Fund Managers.

2) European Market Infrastructure Regulation (EMIR)

All OTC derivative contracts considered eligible, entered into between any financial and certain non-financial counterparties, will be required to be cleared by a CCP (Central Counter Party). All OTC derivative contracts not considered eligible shall be subject to risk mitigation requirements, including the exchange of collateral or a proportionate holding of capital. Counterparties to an OTC derivatives trade (cleared or not) shall report details of that trade to a trade repository. CCPs shall be subject to registration and prudential and conduct of business regulation. Trade repositories shall be subject to conduct of business regulation

3) Short selling regulation

This regulation implies the public disclosure of short positions over a certain threshold and requires parties entering into a short sale to have borrowed the instruments, entered into an agreement to borrow them or made other arrangements to ensure they can be borrowed in time to cover the deal. It also requires notification of significant positions in CDS that relate to EU sovereign debt issuers and it provides competent authorities with temporary power to require greater transparency or impose certain restrictions on short selling and CDS transactions

4) Review of Markets in Financial Instruments Directive (MIFID II)

This directive extends the existing regulatory framework both in terms of instruments and firms covered, so that, for example, certain commodity trading firms will fall within scope of the regime. It imposes regulatory requirements on firms undertaking algorithmic trading (including HFT) and imposes position limits on the trading of commodity derivatives. It also imposes restrictions on third country firms providing services in the EU and introduces enhanced corporate governance requirements for investment firms. It introduces enhanced pre- and post-trade transparency provisions in respect of both equities and non-equities.

Conclusion:

We have seen that Hedge Funds will face many ongoing challenges to keep up to speed with the evolution of the regulatory environment and update their operating models accordingly. Fund managers will have the choice of taking either a reactive approach or a proactive approach to regulation. In a reactive approach, managers will adjust their operating models, compliance and organization structures ex-post regulatory changes. In a proactive approach, managers will try to anticipate the impact of regulatory changes on their operating model. They may thus gain a substantial competitive advantage.

As a concluding note and to open further debate, it is worth mentioning that one of the pitfalls of regulation is actually over-regulation and a lack of well-targeted and adapted regulations. It is thus interesting to look at regulation in the financial industry from the Hedge Fund angle. There is a clear need for regulation on the banking industry. However, imposing heavy regulatory burdens (that are costly from an operational and legal perspective) on a vast majority of small hedge funds, most of which too small to threaten financial stability, may not be the most optimal response to reduce systemic risk, and a more balanced and layered approach to Hedge Fund regulation might in fact be preferable.

Related Posts:

Financial Regulation and the Hedge Fund Industry – Part 2

Financial Regulation and the Hedge Fund Industry – Part 1

Jean Lehmann is an independent consultant and editor and business ambassador to Hedge Think. He currently lectures at INSEEC on Banking Management and the Hedge Fund industry, and is a member of Keiretsu forum, a global investment community of accredited private equity angel investors, venture capitalists and corporate/institutional investors. Jean has extensive consulting experience for leading such projects as the market entry strategies in the Brazilian market of several mid-size to large European financial institutions. Jean has considerable knowledge of the Hedge Fund and Asset Management industry, for having developed as a quantitative analyst some of the most sophisticated financial models in the structured finance product market for a leading US Hedge Fund and a German investment bank. He also has particular expertise in the field of Network Security and Cryptography. As a research staff member at IBM Zurich, he developed innovative algorithms for anonymous communication systems. He was also in charge of Brazilian security consulting services for Gemalto and recently completed a CyberSecurity consulting study for a European airline company. Jean holds a MSc. in computer science and telecommunication engineering with an emphasis on network security and cryptography from ENST Br/EPFL, a DEA in financial mathematics from HEC School of Management, and an MBA from INSEAD