Scandinavian Capital Markets – SCMForex.com’s Chief Investment Officer David Bouchahda talks with Hedgethink.com about the new Swedish fund strategy, technology and the rapid growth of the upcoming Scandinavian FX market. During the interview he mentions their focus in institutional and fund partners and their proprietary research, algorithm to support trading and market outlook.

1. Tell us more about your new launch and strategy?

Nordic Waves is the fruit of six years worth of extensive research, trials and testing before unveiling it to a selected group of our institutional and fund partners this month. The strategy is a systematic short term strategy that we developed since 2009 that mainly focuses on short term price movements on the major currency pairs which are defined and categorized into different sub-levels and environments with specific characteristics and trading parameters.

Our proprietary indicators and signals are built to scan and detect different real-time market patterns and dynamics where the main aim is to be able to find an advantageous set of micro-trends and setups in all different type of market climates to be able to deliver consistency to our investors. The main component of the algorithm is that every defined range or market environment has its own specific key financial and mathematical parameters based on computed historical data which makes the system well equipped to find attractive opportunities even in times where there is low volatility as the system makes constant adaptations based on current market movements.

2. What makes it unique from other strategies and able to deliver alpha?

The fundamental approach and goal with the system was to be able to create a system that can handle ever changing market conditions and dynamics and achieve growth irrespective of the market climate. We spent several years scanning, researching and observing the market behavior on different currency pairs to identify both regular as well as irregular behavior patterns. We noticed that most strategies will often be able to handle one sequence or aspect of the market but often do poorly in another set of market conditions.

This has been a challenge for many traders throughout the years as they have often relied on one type of strategy to deliver and when market conditions and dynamics change, the strategy often struggles to adapt and as a result underperforms. This gave us the challenge with new strategy; how to efficiently handle the market dynamics and changes while at time same time ensuring proper risk management.

The key feature of the algorithm is adaptability as it is designed to work in all different type of market climates as it detects and scans every pattern and historical data and selects the most appropriate execution and option for that particular set of circumstances. This ensures it is agile and flexible and can weather markets where conditions are harder for single strategy funds.

3. What type of clients are you targeting with the new strategy?

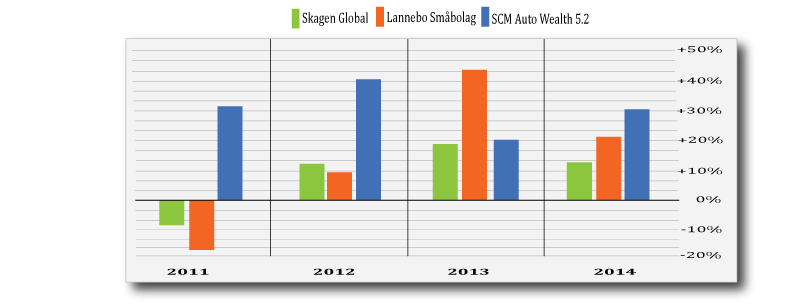

The algorithm is mainly built for our institutional partners such as banks, investment funds, asset allocators but also High Net Worth Individuals. Our growth and client base has historically been from the institutional world as many investors have become more cognizant about diversification and exposure towards the stock market given the recent years volatility.

The trend has been gearing towards a more balanced portfolio with alternative and uncorrelated asset classes that can help to reduce a portfolio’s total return volatility which provides a better total return consistency to the clients on a long term basis. Although our growth has historically been from the Nordics and Europe, we have started to see an increasing interest from the Asian region and have recently established some new partnerships in Hong Kong that will help our long term growth in the Asian region.

4. Where do you think the future lies, systematic or discretionary trading?

The main advantage with the systematic and algorithmic approach is that the risk management process is coded and back tested from the start. A potential investor knows in advance what the potential drawdown is going to be and in what way the algorithm will trade. In addition, the potential for human errors and emotions that manual traders often are affected by in trading are also completely eliminated as the algorithm will only perform the tasks it is programmed to do irrespective of human psychology.

In the industry as a whole, there is definitely a gradual shift towards the systematic approach which can be seen in that a lot of the sell-side firms have found their clients increasingly turning to automated systems due to cost-cutting but also because of many senior traders in the institutional world have been forced to leave due to ongoing investigations of misconduct.

5. There has been a lot of talk about regulation in the industry. Where do you see it going from here?

Regulatory investigation into the FX markets has undoubtedly had a big impact on the industry the past few years and will most likely continue to be in the spotlight given the fallout from the SNB Black Swan event in January. Although the past regulatory investigations has predominately been on the banking practices and misconducts, the new focus will likely be to the potential vulnerability in the regulatory structure after the SNB event as retail FX is still the only retail trading that is done off-exchange.

There have been more calls, particularly in the US, to shift FX into an exchange which has gathered increasing support from the industry as it would likely increase the transparency, prevent manipulation and benefit consumers in a way that is not possible in the current OTC structure. All of these potential regulatory changes will most likely slow growth, particularly in the retail segment, however will in all likelihood be welcome if it leads to healthy changes that gives the market the credibility it needs moving forward.

6. What are the prospects of growth for FX market in the Scandinavian region?

The Nordic FX retail market currently comprises roughly 5% of global FX traffic which is quite small number in comparison to the bigger and more established FX markets. The region has traditionally been a very bank dominated market and investors relatively risk averse which has resulted in many of the investors sticking to traditional investments such as bonds, mutual funds and equities.

However, we have started to see an increasing shift in the sentiment post crisis as a new generation of investors have started to discover the benefits of uncorrelated returns that the currency markets can offer as a diversification to the overall portfolio. Given the high GDP and connectivity in the Nordic countries, we have also seen more actors trying to get a share of the Nordic market as the global Forex market has been increasingly crowded which may ultimately increase the popularity of the asset class in the region and make it more mainstream in the foreseeable future.

7. Finally, what’s your outlook on the Majors in the coming months ahead?

The driving force of the currencies is the search for safety and yield by investors all over the world. This theme will be the predominant one moving forward for the rest of the year. However, we have gone from an era of Fed guidance over the last little bit back to a dependency on data that emerges on a day to day basis.

The big question in everyone’s mind is obviously whether or not the Fed will hike the rates and if it will be in 2015. Nobody seems to know for certain at this point, however what we do know is that everyone will be watching data very carefully, especially on the GDP to pick up from the slow first half, in order to get any cues with regards to a potential rate hike. Other factors will also be for inflation to get closer to the 2% and for employment to reach full capacity. A positive sign so far has been that a lot of retailers and food companies have increased their minimum wages in the first quarter of the year which might have a positive spillover in the coming months.

If the Fed doesn’t look like they can stick to their word, just remember how badly the GBP was punished for flaunting rate hike possibilities and then backing away. We saw a rapid decline from 1.72 to 1.46 over a few months and the USD can be battered just as easily against their peers if they are deemed unreliable. Having said that, if all goes well and the first quarter was unlike what we expect to see the USD should see a resurgence near the latter part of the year.

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals