A recent report by Deutsche bank has shone a spotlight on the trends that are currently affecting the hedge fund industry. Here, we have provided a digest of the main points of this survey, which will soon be published on the Deutsche Bank website.

Overview

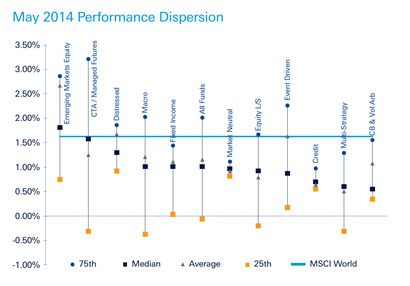

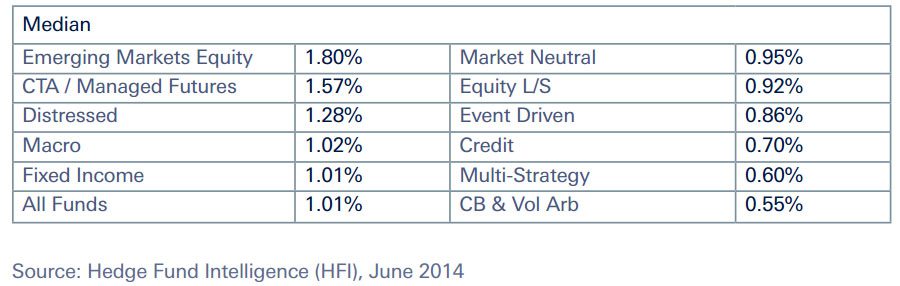

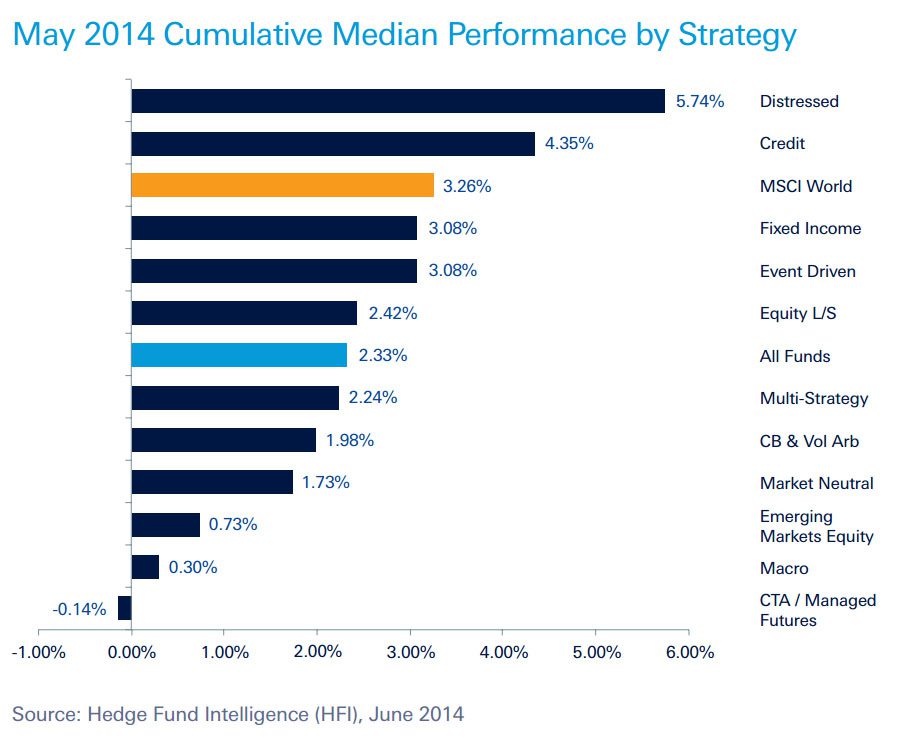

After two months of losses, the hedge fund industry as a whole enjoyed a strong May, with gains in all strategies. The average gain for the entire industry over the course of the month was 1.01%, led by headline gains for distressed strategies (average 5.74%) and credit strategies (average 4.35%).

In Europe and the US, investors seem to be continuing to favour event-driven strategies, and this may be in part driven by an increase in the deal flow for these strategies during 2014. There has also been an increased demand for long-dated credit and special situations opportunities among allocators based in Germany, the UK, and Scandinavia.

Emerging markets strategies, a strong source of growth in recent times, recorded relatively modest but nonetheless solid average gains of 1.80%. Macro strategies in the Asian markets continued to deliver, with gains of 2.23% for May and 1.21% over the course of 2014.

In Europe, performance continued to be led by credit and event-based strategies, which were both up 3% for the year, while in the US, CTA / managed futures saw a big recovery with a rise of 1.42% during May. On a global scale, the returns were highest for CTA / managed futures, macro strategies, and emerging markets equity strategies.

In terms of leverage, the MSCI World 30-day volatility was down by 38.11% for the month, with a closing figure on May 27th of 5.52. Fundamental gross and net fundamental equity ended the month at 2.64 (-2.26%) gross and 0.70 (-2%) net.

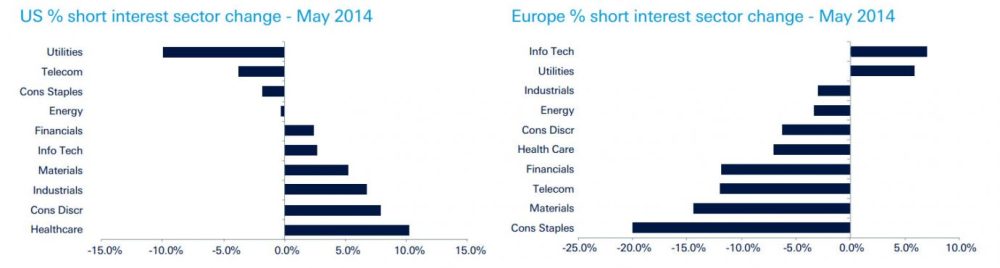

With regards to securities lending, M&A activity was less pronounced than it has been in the last few months, while European convertible bond deals saw an upsurge with a total of 1.48bn during May. Much of the short-selling activity in the US centred around biotech firms Medivation and Pharmacyclics. An increase in sales tax in Japan caused record inflation levels coupled by a sales decline that spurred a lot of short-trading interest in the retail sector of that country, while Chinese banks saw the largest quarterly increase in bad loans since 2005, which cast the spotlight on China Cinda Asset Management and Minsheng Bank. Meanwhile, the continued political unrest in Thailand saw outflows from Thai tourism, retail, and property double over the month.

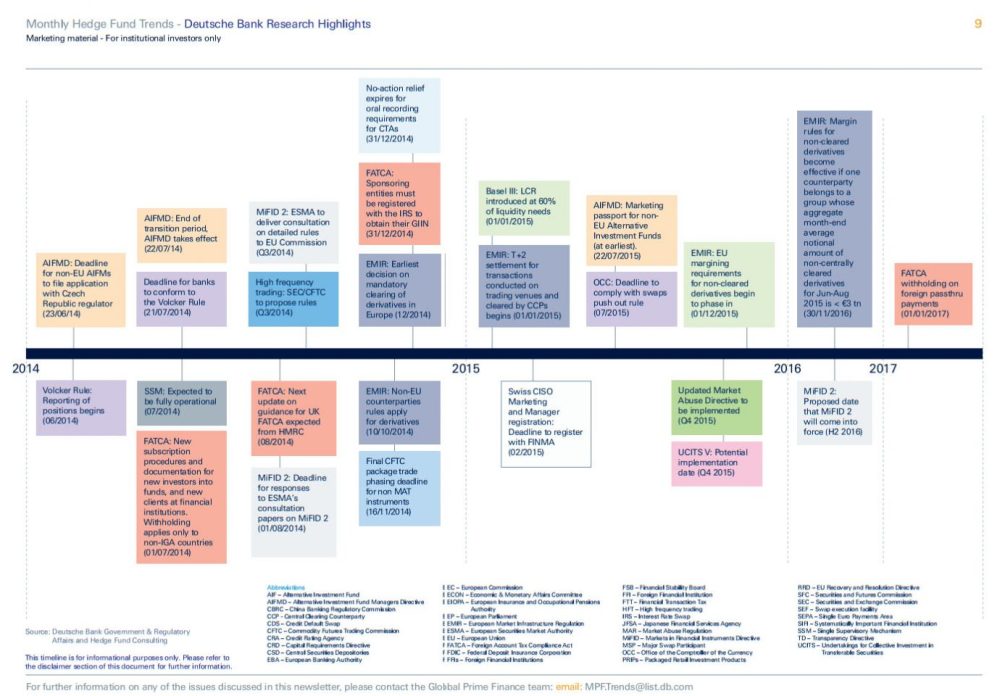

Regulation

Post-crisis regulatory shifts continued apace in the US and Europe during May, with the SEC chair White outlining a new set of initiatives with regards to market structure, in particular broker conflicts, high frequency trading, fragmentation, and the quality of markets for smaller companies. The CFTC gained two new commissioners, and also extended relief for package transactions.

The incoming FATCA regulations, principally aimed at curbing tax-evasion via offshore investments, gathered further support with the IRS announcing a list of over 77,000 banks and foreign financial institutions that have registered for the scheme. Meanwhile, in Europe, the AIFMD transitional period is scheduled for expiry on 22nd July 2014, while ESMA started the process of developing the implementation of rules for MiFID II and the UK’s new financial services regulator the FCA finalized changes to its rules regarding the use of dealing commission by asset managers.

LTRO

In early June, the ECB delivered an unexpectedly large package of monetary stimulus measure, with a new targeted LTRO (Long Term Refinancing Operations) being the main event. This is sure to have a dramatic effect on banks’ funding costs, the demand for credit, and ultimately GDP. Although there is a lot of uncertainty surrounding this exercise, it is widely expected that a drop in the funding cost of banks lending to the corporate sector will have a noticeable effect on the economy, ending the trend towards margin replenishment that began in mid-2012.

Although the effect on GDP is likely to be fairly limited, there has been a much more pronounced effect on the the peripheral bond market, and this can be considered to be a rational interpretation of the available ECB guidelines on this new instrument, with the ECB seeming to be relaxed about the prospect of returns from the carry trade diminishing, which they hope will help to push more asset allocation towards private sector lending.

US Labour market

The US employment report for May fell roughly in line with expectations, with the May gain being less than the April increase, while the unemployment rate stayed in line with consensus expectations. Perhaps the key finding was that the aggregate hours rose in tandem with a sharp drop in real GDP growth over the quarter. Overall, the findings from the labour market are in keeping with expectations that the economy is expanding beyond its long-term potential, and that we can expect the unemployment rate to decline further, pushing inflation on an upwards trajectory.

In spite of the unchanged level between April and May, the ongoing decline in unemployment is encouraging, with a steady decline of 1% per year being recorded over the past three years. The rate has been skewed to a certain extent by a trend for unemployed individuals giving up and leaving the labour force, and in response the Fed has announced that is the unemployment rate declines due to participation issues rather than job creation that it would not use this as a basis for policy changes. Therefore, it will be crucial to monitor this aspect when evaluating the monetary policy response to these figures in the months ahead.

China’s Property Cycle

The property market in China is entering what can be described as a cyclical downturn, with prices and sales volumes falling in many cities. However, this is far from being a new trend, and has been seen no less than three times in the past six years, and in each occasion rebounded.

In response, developers have yet to enter into a policy of aggressive price-cutting, but it is expected that they will soon do so, especially in light of the Chinese authorities’ seeming unwillingness to support the market by easing home purchase restrictions or credit. With this in mind, it is expected that the market may bottom out by the end of the year, laying the ground for another round of large-scale price increases.

Investor Sentiment

In Europe, the two most in-demand strategies are still equity long/short and event-driven, and this has no doubt been driven by the uptick in deal flow in 2014:

- In Q1 2014, Western European buyers announced 60% more acquisitions than in Q1 2013

- In the same period, IPO activity was at the highest levels since 2007

- Investor interest in event-driven strategies has been driven by an influx of high-quality launches in the space

Over the past few months, there has been an increased demand for longer dated credit and special situations opportunities from UK, German, and Scandinavian investors, and these investors are typically willing to lock up capital for 3-5 years in order to access these less liquid credit investments. Although many allocators have traditionally gained exposure to these through multi-strategy managers, there has been an increase in demand for investments dedicated to these strategies, with investors keen to profit from Europe’s credit squeeze and the pressure on the balance sheets of European banks.

On the whole, investors have shown greater interest in ‘one item’ investments with an attractive return profile that they find easier to understand, while at the other end of the scale some large fund of funds have said that they raised a lot of capital for UCITS strategies.

Securities Lending

After a frantic month in terms of M&A activity, the market seemed to cool down in May, with the merger between Dixons Retail and Carphone Warehouse being the main stock-for-stock deal for the month. Meanwhile, the hotly-anticipated merger between Pfizer and AstraZeneca was put on ice, while the mooted Publicis and Omnicom merger was cancelled.

But in spite of the large number of public holidays, May still saw six convertible bond deals totaling 1.48 billion, albeit with many of these coming from an over-subscribed property sector. The only big, investment grade name deal in this regard came from Industrivarden, which issued bonds that were exchangeable into ordinary shared of ICA Gruppen AB.

There were few earnings surprises in Europe in Q1, with first quarter earnings being broadly disappointing, and securities lending flow being muted throughout May due to an increase in risk-reduction among hedge funds. However, flows from fundamentally-driven funds remained healthy, with large investments from Weir Group and Elekta amongst others.

In the biotech sector, short interest increased somewhat, with the headline figure being a decrease in shorts in Californian biotech firm Amgen falling by over 9% while shorts in Medivation and Pharmacyclics grew by 36% and 42% respectively.

In Japan, an increase in sales tax prompted a record high inflation rate and an annualized decline in retail sale of more than 4%, leading to the lowest consumer confidence reading since 2011 and an increase in short interest in the retail sector of more than 9% over the past year. This was led by Sanrio, owners of the Hello Kitty brand, which saw a stock price decline of 14.8%, while electronic retailers became the most shorted subsector after catalogue retailers and department stores. Also, short interest in TDK Corp. and Fujitsu Ltd. increased twofold during May.

In China, nonperforming loans (NPLs) rose to their highest level since September 2008, while short activity in Thailand picked up as a result of political unrest that saw President Yingluck deposed, Martial law imposed, and a governmental coup transpire, with foreigners selling $257m worth of stock, the highest outflow since November 2013.

Regulation

On June 5th, the SEC announced a series of initiatives regarding market structure, including fragmentation, broker conflicts, the quality of markets for smaller companies, and high frequency trading (HFT). This will entail stricter requirements for the technology used by securities information processors, clearing agencies, large alternative trading systems, and exchanges.

A rule has also been proposed for HFT with regards to anti-disruptive trading, which will apply to active proprietary traders in short time periods when “liquidity is most vulnerable and the risk of price disruption caused by aggressive short-term trading strategies is highest”.

There have been several nominations for the CFTC including Timothy Massad as Chairman, and Sharon Bowen and Christopher Giancarlo as commissioners. Also, the IRS has published a new list of FATCA registrants, with 77,000 institutions now signed up. The new regulations came into effect on 1st July, although many of the requirements will be withheld for 2014 and 2015 as long as FFIs are seen to be making good-faith efforts to comply with the regulations.

In the UK, the FCA announced changes to its rules regarding the use of dealing commissions by asset managers. These changes clarify the costs that investment managers can pass on to their clients in terms of dealing commission, with specific reference to to mixed use assessments where substantive research is coupled with services that firms cannot pay for via dealing commission. There will be a broader review of this issue later in 2014.

Other regulatory changes of note include:

- An end to the AIFMD transitional period effective from 22nd July 2014, when relevant funds should either be authorized or have submitted an application to their national competent authority

- An extension to the relief on package transactions on the part of the CFTC.

- The development of more detailed rules to implement MiFID II, with particular regard to pre- and post-trade transparency for bonds and derivatives, a trading obligation for derivatives, position limits for commodities, and controls for algorithmic trading.

- An updated Q&A for EMIR, including the status of counterparties covered by the AIFMD and the treatment of sub-funds.

- The publication of a paper by the Fed examining the link between sovereign debt crises and banking crises.

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.