Fundamental shifts are taking place in the hedge fund industry, according to a recent survey by KPMG together with AIMA and Managed Funds Association. This transformation is bringing changes in the types of investors, markets, products and hedge fund management. Considerable shifts are taking place in the way managers structure, manage and market their products. Let us have a close look at some of the significant changes taking place in the Hedge Funds Industry.

Improvement in performance

Hedge Funds has turned the tide on poor 2014 performance. In the first two months of this year, the Hedge Fund benchmark delivered an annualised return of around 15% as against only 3.8% last year. In recent years the hedge fund managers had to face criticism for the lowest performance among all alternative investment assets. It seems the managers could notice the signal of danger ahead with the exit of CalPERS, the US largest pension fund, from the hedge funds investment.

The managers are trying to deliver strong performance this year to regain the confidence of the investors who were shaken by poor performance of Hedge funds since 2008 financial crisis. It is worth to note, the long term average hedge fund industry performance used to be above 10 percent. Present strong equity markets and turbulent commodity markets provide great opportunities to the managers to demonstrate their skills.

“Fund managers will now have the tricky task of continuing to capitalize on current macro opportunities to deliver the better performance promised in 2015, in order to prove the true value of hedge funds within a diversified portfolio,” says Amy Bensted, Head of Hedge Fund Products, Preqin.

Source: Growing Up: A New Environment for Hedge Funds, KPMG 2015

Shift towards Institution Investors

Historically, alternative investments used to be looked upon as investment tools suitable to meet the special needs of high-net worth individuals only. But over a period of time the investors’ categories have expanded. Hedge Fund is no more an exclusive domain of HNIs.

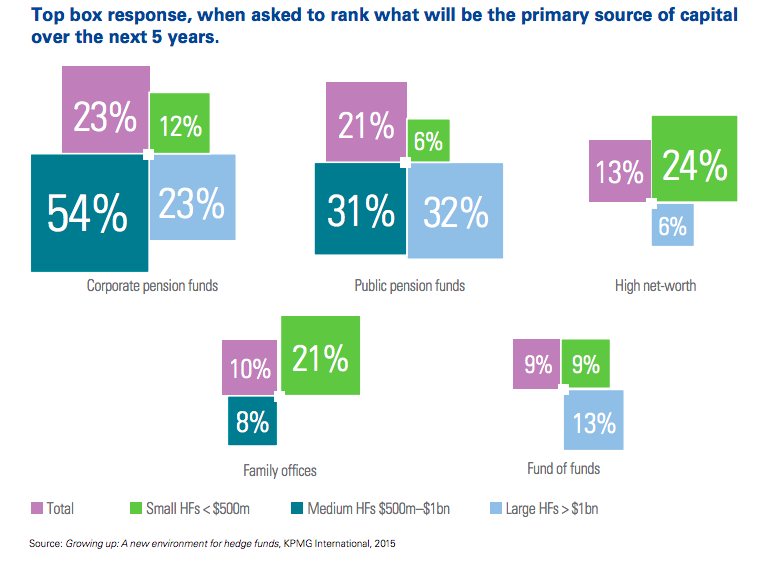

Institutional investors like pension plans, endowments, sovereign wealth funds, and charitable organisations now make up two thirds of the total hedge fund capital. The world population is living longer, it usually means more years after retirement. As a result pension funds have to look for greater return and low volatility. The proportion of capital invested by pension funds in hedge funds will continue to grow.

Source: Growing Up: A New Environment for Hedge Funds, KPMG 2015

New Products

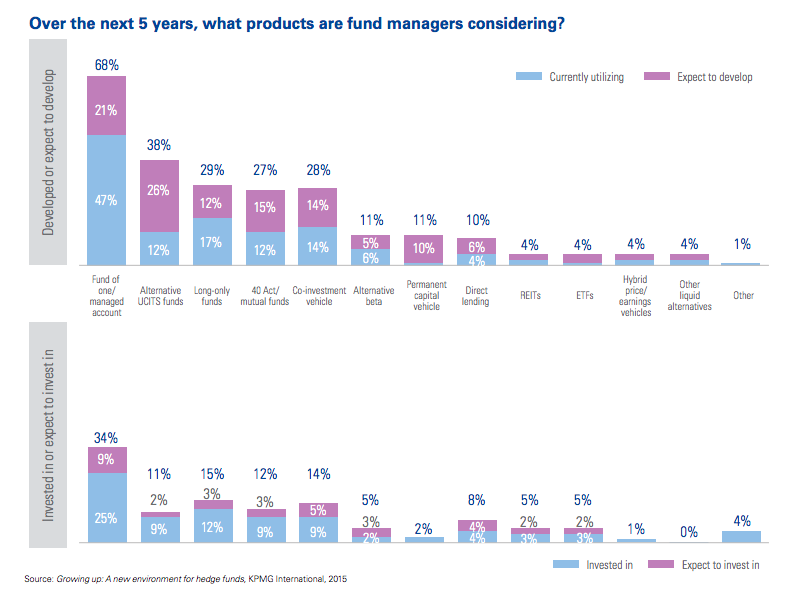

With the rapid shift towards institutional investors, managers are seeing an increased demand for customized products such as funds of one and managed accounts. Investors are also looking for more liquid products with shorter notice period for redemption. Liquid alternative products such as UCITS and 40-Act funds are the fastest growing segment of the asset management industry, according to a report by Deutsche Bank. They provide opportunities to investors to invest in a liquid and regulated structure. As a result, Hedge funds are restructuring their products to attract investors. The managers are offering customised products to their big institutional investors. Managers are no more rigid on traditional 2 and 20 fee structure. The average has already declined to 1.5 and 18.5.

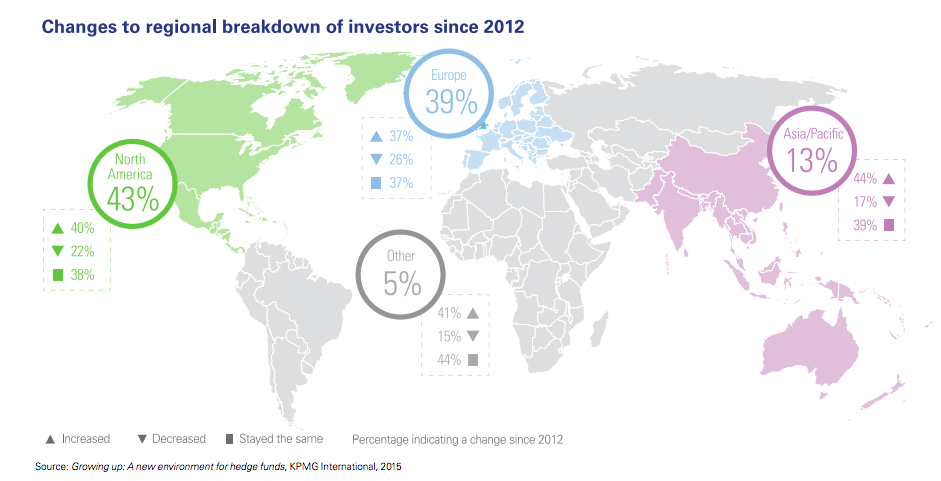

New markets

Hedge Fund Industry has largely remained concentrated in the US and Europe. 43% of capital invested in hedge funds comes from North America, followed by 39% from Europe. More recently, the inflows from developing and emerging markets are picking up. Opportunities for profitable investments have also increased selectively in some of emerging and frontier markets. Fund managers are now shifting their attention to explore new and growing markets both as fund raising and investment destinations. Their focus may gradually shift from west to east. Asia Pacific is becoming an important hedge fund market.

Source: Growing Up: A New Environment for Hedge Funds, KPMG 2015

Leaning towards large funds

New regulations such as AIFMD, Dodd-Frank and JOBS have created higher compliance and requirements. Institutional investors are also insisting more transparency. They ask for more detailed periodical reports from their fund managers. This is time consuming. Moreover after the financial crisis, institutional investors prefer tested and large hedge funds. These have become barriers for small and medium hedge funds. The number of new hedge fund launches in 2014 declined to 1040,the third consecutive year of decline. Hedge fund launches dropped to 1040 in 2014, half from the peak of 2073 funds launched in 2005. Large fund managers are more comfortable in attracting capital from institutional investors.

To conclude, the $2.85 trillion hedge fund industry is passing through a transition phase. Managers are realigning with the changing environment and new markets. Their new strategies, customized products and better performance will keep the hedge funds growth pace intact.

“The global hedge fund industry, which has grown by over 10% a year since the financial crisis, is well positioned to maintain this growth trajectory over the next five years,” says Jack Inglis, CEO, Alternative Investment Management Association (AIMA).

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.