In recent years, the hedge funds have been facing criticism for poor performance relative to S&P 500. Performance-wise 2014 was the worst year, with the HFRI Fund Weighted Composite Index gain of 3.6 percent for 2014, below the long term average hedge fund industry performance of +10.7 percent. And this was much below 11.4 percent gain in S&P 500 in 2014. For the sixth year in a row, the Hedge Fund Index did worse than the S&P 500 stock index.

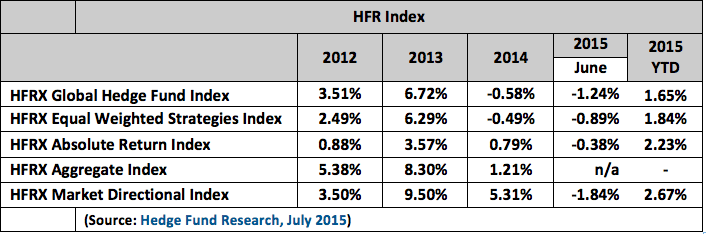

But the Hedge Funds have reversed the trend in 2015. The Hedge Fund Index in H1 outperformed S&P 500 best after 2009. HFRI gained 2.4 percent in 2015 H1, 200 basis points above the S&P 500. This is despite of a decline of 1.24% in June due to increased uncertainties at month end as a result of uncertainty over Greece, sharp decline in Chinese equities and oil prices resuming their slide. June was a choppy month for the financial market. Negative monthly returns were seen in global equities, bonds, investment grade and high yield credit, the US dollar and hedge funds. In June 2015, Hedge funds registered the first monthly loss in the current year. Hedge Fund Index was down by 1.24%, the worst monthly decline since June 2013. However, hedge funds still outperformed underlying markets, such as the MSCI World Index which declined 2.88 percent during the month.

“Increased financial market volatility and reversals of many of the performance trends from the first half of 2015 resulted in declines across many areas of hedge fund performance to conclude the month of June, with an increased focus on hedge fund exposure to and positioning in Chinese and Greek/European equities, Oil and Euro currency,” says Kenneth J. Heinz, President of Hedge Fund Research, a leading source of hedge fund data and indices.

The story for H1 seems to be somewhat different. Hedge funds are up year-to-date.

Here are some key highlights:

- Macro hedge fund strategies with losses across equity and currency exposures led the worst monthly performance since July 2008.

- CTA strategies recorded the worst decline since May 2011.

- Both CTA and Discretionary Macro strategies declined as global yields rose, precious metals declined, the US Dollar fell against major currencies and Agricultural commodities experienced high volatility for June. Government bond yields increased across both US & Europe.

- Events in Greece and China pulled down hedge fund returns.

- Volatility increased into month end as a result of uncertainty over the outcome of the Greece referendum. Increased volatility put pressure on Global financial markets.

- Event Driven Index declined, as equity volatility increased on losses in China and increased uncertainly over Greece referendum. Equity Hedge Index decline was mainly contributed by Chinese and Fundamental Growth exposures.

- Emerging Markets Index fall was mainly due to China

- Activist funds however gained and pushed up Event Driven category performance in the first half.

In general, the outlook is positive for hedge funds through the second half of 2015, though managing short-term uncertainties remains a challenge. “As recent macroeconomic uncertainty develops and evolves in coming months, hedge fund investors are likely to continue to benefit from sophisticated, non-directional and low beta exposures to many powerful, complex and diverse trends in 2H15,” adds Kenneth J. Heinz in an interview on Fox Business TV

Kanchan Kumar is an experienced finance professional and has worked as an Executive Director and Advisor with the MNCs. He is a former banker with two decades of working experience with a Financial Institution. He is a rank holder in MBA (Finance) and Gold Medallist in MS (Statistics). He has passion for research and has also taught at a University. He writes on Global Economy, Finance and Market.