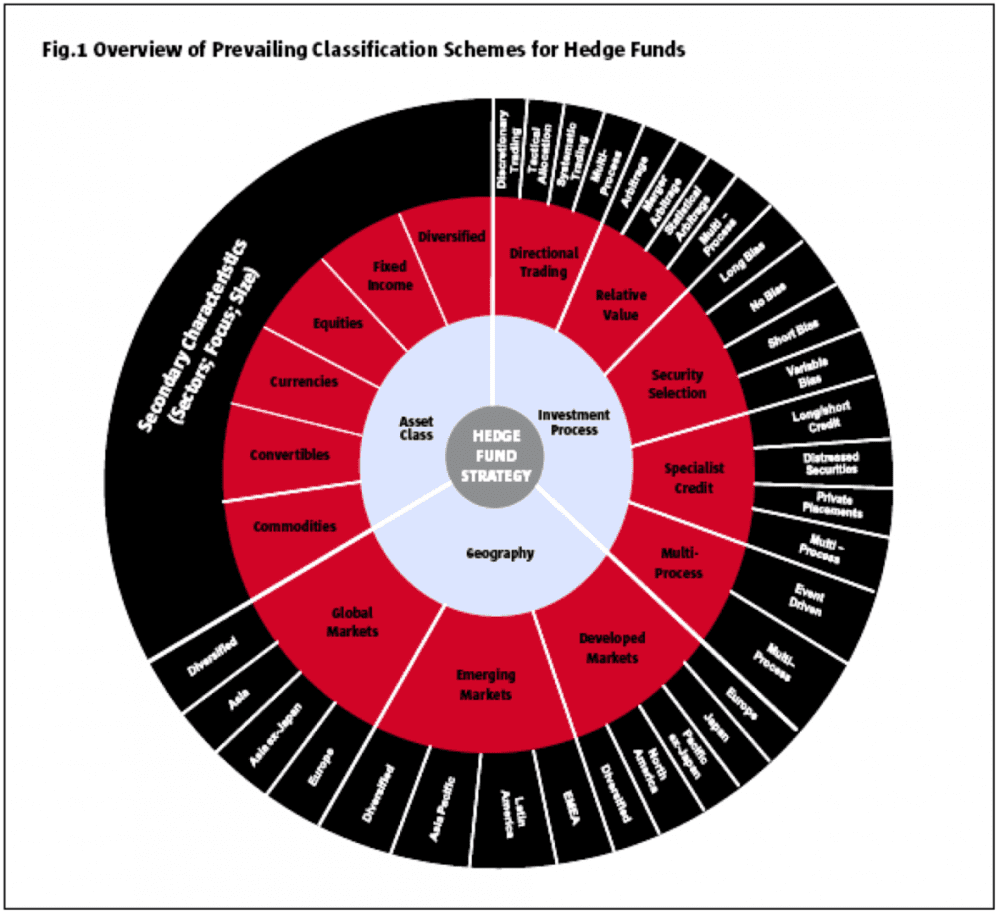

Although hedge funds have always employed a range of strategies to achieve their goal of absolute returns, today’s hedge fund managers have a broader palette to choose from than ever before.

That being said, most hedge fund strategies fall into one of four investment strategy categories. These are:

- Global Macro

- Arbitrage (Relative Value)

- Event-Driven

- Directional

Although many hedge funds will primarily follow one of these strategies, many will employ more than one, or all four in combination to varying degrees.

Global Macro Strategies

A global macro strategy is one that invests in stocks, bonds, commodities, and currencies, as well as financial derivatives such as options, futures, and forwards. Funds that employ these strategies are typically heavily leveraged, placing directional bets on the prices of underlying assets.

The aim of these strategies is to profit from changes in the global economy, often capitalizing on the policy decisions of governments and central banks with regards to interest rates, participating in all the major markets, albeit not always simultaneously.

The impact of these market moves can sometimes be quite subtle, which is why funds such as these use leverage and derivatives to magnify their impact. Although hedging is used, the primary earner for this type of fund is leveraged directional trades. This makes it the riskiest hedge fund strategy, but also the one with the greatest profit potential.

Arbitrage/Relative Value Strategies

This category covers a wide range of different strategies used across several different asset classes, but they all aim to exploit pricing inefficiencies between related securities. The basic idea is to all but eliminate market risk by taking two positions that offset one another, such as using futures to hedge interest rate risk, thereby cancelling out the effects of broader market movements.

An example of this strategy would be to purchase a stock that is trading at $5 and simultaneously sell a futures contract that uses that stock as the underlying asset for $10, locking in a $5 profit minus transaction costs.

Although not many funds operate this strategy in isolation, those that do provide low-risk, moderate returns.

Event-Driven Strategies

This strategy involves capitalizing on event-driven scenarios such as hostile takeovers, mergers, leveraged buy-outs, and reorganizations. It can involve, for example, short-selling equities on the assumption that the company will file for bankruptcy, or simultaneously buying stock in a company that is being bought and short-selling stock in the company that is doing the buying. Returns can be leveraged and interest rate/market risk can be hedged using derivatives.

Directional or Tactical Strategies

These are the most commonly-used strategies by hedge funds, and macro funds can also be considered to fall within this category as they tend to emphasise directional trades. Other common directional/tactical strategies include long/short strategies that combine purchases with short sales, dedicated short strategies that specialise in short-selling over-valued securities, and market-neutral strategies which aim to negate the effect of general market movements.

Why are these strategies used?

There are several reasons behind a hedge fund’s strategy decisions, such as the sector that the fund specializes in, the method used to select investments, the amount of diversification in the fund, and the fund’s approach to the market.

Strategies can also be loosely categorized as being either discretionary/qualitative, in that the investments are chosen by managers, and systematic/quantitative, in that investments are chosen according to a predetermined investment system, which is often computerized. The degree of diversification can also vary between funds, and this can be achieved by adopting several strategies at once, making use of multiple managers, or aggregating the returns from more than one fund.

Common Investment Strategies

Although the strategies employed by funds can often be very complex, they are often centred around one or more basic investment concepts. Here are some of the more common strategy types:

Long Only A strategy where the fund takes long positions on assets such as stocks in an effort to generate ‘alpha’ – returns that beat established market benchmarks. For example, if the FTSE 100 is used as the benchmark for the fund and it is up by 8% for the year, and the fund is up by 15%, the 7% difference between the two is the alpha generated by the fund manager.

Short Only With this strategy, the fund manager aims to make money purely by short-selling. In the case of a short-only equities strategy, the fund manager would endeavour to seek out overvalued stocks by looking for signs of trouble in the footnotes to financial statements or an indication that the competition may be gaining in strength. Given that stock markets tend to move upwards over time, this can be a particularly difficult strategy to pull off consistently.

Long/Short The original hedge funds employed this strategy almost exclusively, and it remains by far the most popular strategy in the hedge fund universe. Basically, fund managers identify assets that are headed upwards, and those that are headed downwards, and bet on both. This is a type of pairs trading, where funds will take long positions in the expected winners and use this as collateral to take short positions in the losers, thereby offsetting market risk and magnifying asset-specific gains.

Specific Strategy Examples

Emerging Market

As the name suggests, this is a strategy that focuses on trading securities in developing countries that are classed as ’emerging markets’. The rapid growth of the economies in these countries means that most of the positions taken are long, and mispricing is a lot more common than in developed markets. To succeed with this type of strategy, the fund manager needs to have strong local knowledge and do a lot of in-depth research.

The comparative lack of regulation in these markets, combined with political and economic uncertainties, poor accounting, and a lack of readily available information makes this a very risky strategy, albeit one that can realise huge returns in the right circumstances.

Distressed

This is an event-driven strategy that focuses on companies that are in financial trouble and are facing a corporate event that can be exploited such as bankruptcy, restructuring, or a distressed sale. Funds that employ this strategy purchase securities in the expectation that the value will increase as a result of the strategic plans of the current management or fundamentals that are stronger than the current pricing would suggest.

Sometimes, funds that invest in distressed securities will take an active role in order to encourage the result they desire, such as getting involved in restructuring or lending arrangements, or buying enough shares to earn them a seat on the board of directors.

In any case, this strategy involves buying bonds that have lost a lot of value due to investor expectations that the company is in trouble or a company’s financial instability. It might be the case that the company is emerging from bankruptcy, which enables the fund to buy up cut-price bonds if they have reason to believe that the situation of the company will improve to the extent where they will rise in value.

This can be a risky strategy, as plans to revive distressed companies don’t always work out, but because the securities are so deflated in price, the returns can be huge if the recovery is even partially successful.

Equity Market Neutral

This is an equities-specific sub-category of the long/short investment strategy that seeks to minimize exposure to the broader movements of the market. There are two ways to achieve this market neutrality with this non-directional strategy. One is to invest equally in long and short positions, keeping the net exposure of the fund at 0% and the gross exposure at 100%. Another is to invest in both long and short positions so that the beta measure of the fund as a whole is as close to zero as possible.

These strategies can be applied to a specific industry, region, or sector, and while the blend of strategies differs from one funds to another, all equity neutral funds are based around long/short strategies such as these.

Quantitative

Image: augmentedtrader.wordpress.com/

Also known as ‘black box’ or ‘quant’ trading, this is an approach that involves the use of sophisticated computer programs to analyse data and statistical models to identify market inefficiencies, and make trades automatically using high-frequency trading techniques. Over time, the algorithms used to make these trades are refined and calibrated by mathematicians to improve their performance and adjust to a changing market environment.

There are countless different quant strategies, and they are evolving all the time, but most focus on making lots of short-term trades, that may only be open for a few seconds or less, in order to make a large aggregate profit from them. While many consider this to be the future of trading – and in many markets the majority of the trading volume now comes from automated trades – it can get ugly when things go wrong. In particular, these techniques have been blamed for ‘flash crashes’ where billions have been wiped off the value of markets in an instant before rebounding shortly afterwards, and this is one of the reasons they are facing increased scrutiny from regulators.

Convertible Arbitrage

This involves a fund taking positions in both the convertible bonds and the stocks of a company. A convertible bond is one that can be converted into a certain number of shares. Let’s say we have a convertible bond that can be converted into 20 shares that is selling for $2,000, which implies the market price of the stock as being $100. The fund manager then goes long on the convertible bond and short on the stock in the anticipation that the bond price will increase, the stock price will decrease, or perhaps both.

Besides the value of the underlying stock, there are two other variables that can affect the value of a convertible bond, namely changes in the interest rate and the embedded option to convert the bond into stock, which is influenced by volatility. So, if the implied volatility in the option portion of the bond is too low, or an interest rate reduction will push up the bond value more than the stock, an arbitrage opportunity is created.

Even if the prices move in the opposite direction to that anticipated by the fund manager, the impact of the movements will be minimal because the position is hedged against company-specific news. That’s why leverage is often used to magnify returns from this strategy, and in order for it to be sufficiently profitable, the fund manager has to enter into a large number of similar positions.

Aggressive Growth

This strategy is centred around going long on equities that are expected to experience acceleration in growth of earnings per share – usually small or micro cap stocks with low or no dividends. Because the failure rate of these ‘growth’ stocks is comparatively high, it can be a risky strategy, but the returns from just one successful investment can often make up for the losses from several others.

In order to ameliorate this risk, these investments are often hedged by going short on stock indices or equities that are expected to see growth tail off, although most strategies of this type are heavily biased towards long trades. These funds are often specific to sectors such as banking, biotech, and technology.

Fixed Income Arbitrage

This strategy aims to profit from discrepancies in the pricing of related fixed income instruments, with the aim of neutralizing interest rate risk. Examples of the types of trade that might be used within this strategy include finding mispricing opportunities in corporate versus government bond yields, long and short credit anomalies, or cash versus futures. As with other non-directional arbitrage strategies, the small profit margins from these trades means that heavy leverage is often used to magnify profits.

Tactical Market Timing

In essence, this strategy involves going long on assets that are beginning an uptrend while going short on assets that are beginning a downtrend. Fund managers use a variety of tools to predict these reversals, including technical, fundamental, and economic data, and a strong sense of the effects of the market on the movement of different asset classes is critical to succeeding with this strategy. This strategy gives fund managers the freedom to trade across all the different asset classes, but the inherent unpredictability of market movements and the difficulty in identifying optimal entry and exit points can make returns from this type of fund comparatively volatile.

Managed Futures

With this two-tier strategy, fund managers invest in financial and commodities futures markets using a combination of directional trades and hedging. The first tier of this strategy involves combining short-term pattern recognition with a longer-term trend-following approach, while the second tier uses an automated trend-following strategy across multiple markets.

Image: intelligenthq.com

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.