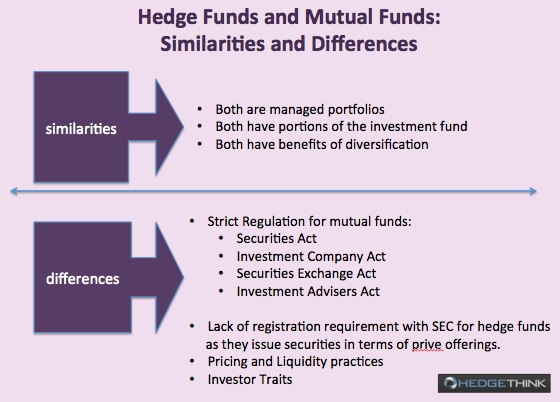

Sometimes people use the terms hedge funds and mutual funds interchangeably, which is incorrect as they have some marked differences between them. First, lets look at some of the similarities between them which prompt this confusion.

- Hedge funds and mutual funds are both managed portfolios. Both have portfolio managers that attempt to generate the highest rate or return by selecting the best securities that will perform well in conjunction to the other securities in the managed portfolio.

- Both have portions of the investment fund that is eventually sold to potential investors who can then participate in the gains and/or losses of the various holdings.

- Both investment funds have the benefits of diversification and professional expertise and management of the investment capital.

Now, for the differences between the two; they both have some significant differences in terms of the fees charged, leverage, liquidity and pricing, and the general regulations and guidelines that are rendered.

- Regulation Guidelines: Mutual funds are normally more heavily regulated than hedge funds. They have to register with the United States Securities and Exchange Commission (SEC) and other forms of rigorous regulatory oversight. Almost every aspect of the mutual funds activities and structure is monitored under strict regulation from the following federal laws:

- Securities Act (1933)

- Investment Company Act (1940)

- Securities Exchange Act (1934)

- Investment Advisers Act

All these various laws monitor mutual fund operations from the safeguarding of funds that are required for their portfolio requirements to the detailed book keeping information. Regular performance reports are also demanded via these laws.

On the other hand, hedge funds are not at all required to register with the SEC as they issue securities in terms of private offerings that are not registered as per the Securities Act (1933). Periodic reports do not even have to submit under the Securities Exchange Act of 1934. However, like all managed portfolios and investment dealings, they are subject to fraud violation penalties.

- Fees Charged: Due to federal law regulations, there is a fiduciary duty on a mutual funds manager for its compensation of the funds it receives. Additionally, mutual fund sales charges and distribution fees are subject to the particular regulatory limits as per the NASD rules. Furthermore, mutual fund fees and expenses are supposed to be disclosed in detail as per the law and there is an accompanying fee table that is mentioned in the prospectus for the potential investors convenience. On the other hand, hedge fund managers have the leeway to charge any fee they want to charge the investors. Also, the hedge fund manager can charge as asset-based fee and an additional performance fee, some have the front-end sales charges too.

- Leveraging Activities: For mutual funds, the Investment Act strictly limits the mutual funds ability to conduct leverage and/or borrow against the value of the various securities in its portfolio. The SEC requires the mutual funds that engage in an array of investment techniques such as options, futures, short selling and forward contracts to cover their positions. These constraints limit the leveraging activities of the mutual funds.

On the other hand, hedge funds are the epitome of high level and sophisticated leveraging and many other complex investment strategies. The hallmark of hedge funds is the usage of heavy leverage and short selling to reduce the portfolios exposure to the markets volatility.

- Pricing and Liquidity Practices: The valuation of portfolios is mandatory for mutual funds and also the pricing of their securities that are based upon the daily quotations of the market that should be readily available at the prevailing market value. In good faith must be decided upon at the discretion of a board of directors of the mutual fund. The mutual funds shareholders are allowed to freely redeem their shares at their discretion. For hedge funds, there are no concrete governing ground rules for hedge fund pricing.

- Investor Traits: A minimum investment to open an account at a mutual fund company, which is around $1000, is only required for investment, this amount can vary though. After the account has been made active, there is no further investment that is required. For hedge funds, the initial investment requirement is much higher. The hedge fund investors typically need to have an investment capital that ranges from $ 1 million to $ 5 million. This is usually done to limit the hedge fund participation, as it is an unregulated pool of investment.

Read More:

which item is a benefit of using the travel card

how does a block of data on a blockchain get locked?

why is it useful to have your bank account and routing numbers when using tax preparation software?

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals