In a recent survey carried out by the Family Offices Group, several of the 200-odd respondents hailed from California, and all of these were targeting investments and co-investments in the range of $500,000 to $5 million, the most common answer in the study as a whole. California-based family offices also expressed a marked preference for minority investments, limiting their exposure to any one particular deal by, for example, investing alongside an established co-investment partner.

This move towards an almost exclusive targeting of small-to-mid size investments is at odds with the trend in previous years of family offices and co-investment groups executing large deals.

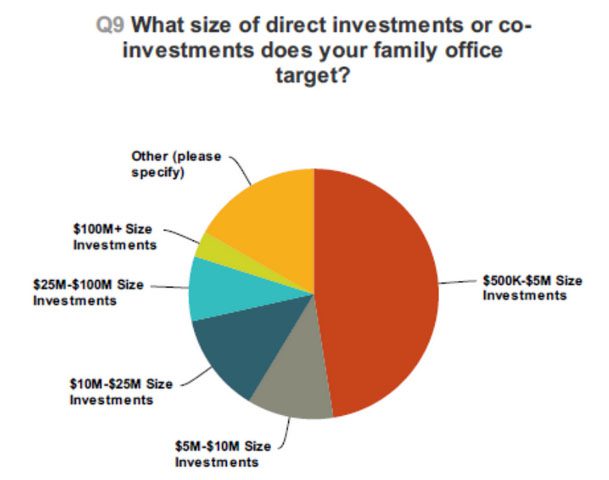

So while you can see from the pie chart above, the responses for the entire survey in terms of the size of investments being pursued was a bit more varied than the California group, although the overall trend was the same. With the survey data suggesting that California family offices have a strong preference for taking less active positions with a majority interest, the body that published the survey – the Family Offices Group – also states that it expects that these family offices will most likely expand their investment activities and take a more active role in the future.

In order to do this, though, they will need gain experience by making smaller investments, expand their deal capabilities, and employ more seasoned investment professionals in order to position themselves for the potentially much more lucrative large deals, such as taking majority stakes in companies and investments.

One other interesting finding from the Family Office Benchmarking Survey is the way in which the portfolios of representative Californian single and multi-family offices are composed. All of the respondents reported that they were dedicating a proportion of their portfolios to traditional investments such as long-only, mutual funds, stocks, and ETFs. Even the most ‘alternative’ portfolio had 20% made up of such investments, and one respondent indicated that the entirety of the family office’s portfolio was invested in traditional assets.

That said, the majority of California family offices reported that they had at least a degree of exposure to alternative investments such as hedge funds and private equity, but these never amounted to more than 20% of the portfolio, in keeping with the standard diversification policy used by most family offices.

Direct investments also represented a large chunk of most California family office portfolios. It is quite frequently the case that high-net-worth families typically invest a significant proportion of their capital in real estate and other hard assets, and one respondent stated that 70% of its portfolio consisted of real estate and other hard assets. This has been a big trend in recent years, with investors picking up real estate at a huge discount following the bursting of the housing bubble, although the continued high portfolio percentages dedicated to these in California is exceptional in the wider context.

California family offices vs NYC and other family office hubs

There are huge differences in the sizes, structures, and services of family offices between different city and regional hubs, reflecting the investment culture and the peculiar circumstances of that area. For instance, the family office community in New York is highly developed, with regular events and meet-ups, frequent joint ventures and co-investing efforts involving more than one family office, and the offices (mostly located in Manhattan) are well-established, highly experienced, and efficient.

Although California family offices are usually fairly sophisticated in terms of their structure and operations, most single family offices are a lot more private thant their New York brethren. In New York, family offices tend to be a lot more active in the financial and investment community, frequently participating in industry and networking events. Also, they tend to have a more active investment team that spends a lot more time listening to presentations from potential deal partners and investment firms than Californian family offices do.

There are several reasons for this. One of the main ones is logistical – it’s simply a lot easier for investment firms, most of which have a branch office in New York, to attend multiple meetings in midtown Manhattan than it would be drive or fly round California, where the family offices are more widely geographically dispersed, to do the same.

As is the case in New York, there are a lot of wealthy individuals in the major cities of California and it is hard to know ahead of time whether you are meeting with a very wealthy family office ($100m+) or just an advisor to a high-net-worth family (sub-$100m). This is less of a problem in New York, where the shorter journey times mean that a misunderstanding or a misrepresentation does not waste as much time, but it is a common frustration among family offices and those hoping to work with them in California. In many cases, an investment firm will travel to meet someone only to find out they have been exaggerating about their wealth or they do not understand the difference between an upper class family and a single family office.

It can be a lot easier to distinguish affluent families from the true single-family offices in smaller cities, as it is easier to spot the big fish in a smaller pond. However, in California it can be a lot harder to work out who the truly wealthy and active family offices are and how you can connect with them.

This problem is exacerbated by the lack of a formal family office community in California and the west coast in general, compared to the ones that exist in New York and smaller hubs such as Chicago and Miami. This also makes it harder to put into action the co-investments that are preferred by so many family offices, as it is difficult to build a strong co-investment network or link up with other single family offices in a community that is so geographically dispersed and lacking in formal structure.

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.