The hedge fund industry has seen some dramatic changes over the past decade, especially in the wake of the financial crisis of 2007-2008. Perhaps the most illuminating barometer of these changes has been the trends in capital allocation – the market analyst’s equivalent of the old detectives’ trick of ‘following the money’.

By looking at where the money has been going – bearing in mind we are dealing with some pretty sophisticated investors here – we can shine a light on the underlying forces that are shaping the current investment environment, and in particular the movement of institutional money out of traditional long-only equity and debt markets and into the hedge fund industry, which up until recently was the sole preserve of high-net-worth individuals and wealthy families.

Inflows continue

In November 2013, investment flows into hedge funds continued for the fifth consecutive month. In that month alone, new allocations totalling $15.3 billion brought the cumulative total for the five-month growth period up to $68.5 billion in capital inflows. This brought industry-wide assets under management (AUM) to a five-year high of $2.84 trillion, just over 3% behind the pre-crisis peak. And while this is remarkable in itself, it is by most measures a conservative assessment of the situation, with other data providers including Hedge Fund Research indicating that the industry as a whole has in fact gone beyond the previous peak, and that asset are currently at all-time record levels.

Equity investments in pole position

This growth has largely been driven by investments in equities, and according to the eVestment research, the majority of the new assets in November were invested in equity strategies. The level of allocations into funds pursuing long/short equity strategies was at the highest level in November since August 2009 – more than four years. However, this influx seems to have been heavily weighted in favour of long/short hedging strategies, as there was actually a notable decline in the amount of capital being attributed to investment vehicles based on long-only equity strategies.

This was a global trend that was in evidence in the second quarter of 2013 not only in developed markets, but also in emerging markets – to a large extent, money was flowing out of long-only equity strategies and into long/short equity strategies designed to counteract the risk associated with wider market movements. This is a trend that grew significantly in the third quarter, and in many ways this trend has been driven by the strong bull market for equities in developed markets.

Sophisticated investors appear to continue to desire equity market exposure, but want it from more flexible products with the ability to quickly hedge or shift directional exposure said eVestment in their survey notes.

Credit loses its lustre

The main victim of this trend towards equity investment appears to have been the credit markets. Credit-based strategies, which were immensely popular in the years following the financial crisis – specifically between May 2010 and June 2013 – have been losing ground to equity-based strategies.

The reason for this is fairly simple – the financial insecurity that followed the crisis pushed up the price of borrowing for governments and corporations, due to the increased risk of default. As a result, huge profits were to be had by investing in debt that was being acquired at a high premium in terms of interest rates.

But as the global economy started to stir back into life, the risk of default ebbed away and borrowing rates fell as a result, while at the same time the stock market went into a massive rally. Naturally, this made equity markets infinitely more profitable for traders pursuing strategies based on this market, while debt-based strategies – for example, fixed-income arbitrage – saw their opportunity set reduced by degrees.

This difference was accentuated by the uncertainty surrounding the US Federal Reserve’s much-delayed plans to begin cutting back on their bond-buying monetary stimulus programme, also known as quantitative easing. This scheme, which effectively amounted to printing money in order to control interest rates and hopefully encourage economic growth, was one of the main factors in driving the bull market in stocks during 2013. At the same time, market uncertainty over when the so-called ‘tapering’ of the Fed’s QE caused quite a degree of volatility in the credit markets, with Treasury yields spiking on numerous occasions due to speculation about the Fed’s next move.

Global macro falls out of favour

Global macro strategies, such as those employed by traders such as George Soros, John Paulson, and Paul Tudor Jones, have one innate advantage over almost all other strategies – in the right circumstances, they can provide better returns than any other strategy. This effect is particularly pronounced during strong bear markets, and in fact every one of the traders mentioned above made their names with blockbuster profits made during market tailspins. For example, John Paulson made his name by shorting the sub-prime mortgage market, which caused global economic chaos when it collapsed, but made Paulson and his investors wealthy indeed.

As a degree of stability returns to the global economy, the opportunity set for this type of trader has been markedly reduced. Macro strategies achieve, on occasion, blockbuster returns by placing big bets against what they perceive to be the flaws inherent in a particular economic situation, and waiting until that flaw corrects itself. However, they can’t do this every year, and a period of sustained low-rate economic growth without any major upsets is patently not the time to do it.

As a result, global macro funds have suffered – for example, the biggest hedge fund in the world – Ray Dalio’s Bridgewater Associates – returned just 5.3% from its flagship $80 billion Pure Alpha fund in 2013. To put that into context, the S&P 500 grew by 26.5% over the same period – over 20% better than a team of elite macro investors. it was a similar story at most other macro funds during 2013, with the notable exception of John Paulson, who staged a big comeback that year having posted disappointing returns for the previous few years.

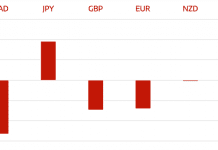

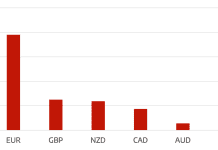

With macro strategies looking less attractive in the investment climate of 2013, investors turned their back on them to a certain degree, with fund flows to global macro and managed futures strategies both negative in November. This rush of investors taking money out of macro strategies bucked the overall trend of money flowing into the hedge fund industry. In the report, eVestment said: Flows were mixed for the largest macro funds and investors appear to be aligning new allocations with those funds able to perform well in the recent global environment.

Long/short strategies take over in emerging markets

For six months out of the seven leading up to December 2013, emerging markets saw positive fund flows. However, beneath this surface statistic there is an underlying sea change in evidence, with investors moving away from long-only emerging markets equity strategies towards long/short strategies in order to hedge risk. So despite the flow of money into emerging markets equity strategies, the level of investment in long-only equity strategies actually dropped during the third quarter of the year. eVestment said: It is an important market sentiment indicator when institutional investors opt for hedged over long-only exposure to developed and emerging markets.

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.