The hedge fund industry is evolving at a rapid pace, and since the financial crisis the industry has seen sweeping changes. Here, we will talk a bit about the effects of these changes, as well as how we might expect the industry to evolve further in future.

Fund of Hedge Funds

The long-standing criticism of the fund of hedge funds model, in which the fund manager is paid to invest in a portfolio of hedge fund investments, has been that this structure creates an extra level of fees on top of those charged by the funds being invested in. Some feel that this will ultimately be their undoing, and that investors will eventually become savvy enough to cut out the middleman. However, there is reason to believe that funds of hedge funds will continue to have an important role to play in the industry, but they will have to evolve in order to survive.

Over the past few years, the role of these funds has already changed, and this is a signpost that this is a sector that has the capacity to change. What these funds provide, in essence, is a greater level of access to an elite investment class for non-institutional investors. So while institutional investors will most likely turn away from such funds in favour of direct investments, those individual investors who cannot access many funds directly due to heavyweight capital requirements or because certain funds are now closed to new investments can still benefit from them via these vehicles.

Like the industry as a whole, the fund-of funds business is evolving, and the role that they serve seems to be changing. Fund of fund managers are moving away from providing a product towards providing a service, which could involve helping an institutional investor through a managed account or providing a point of access for investors who have performed the manager selection, evaluation and monitoring process themselves.

Consolidation

With more and more institutional money flowing towards the top hedge fund managers, it seems as though the industry in ten years will be a lot more consolidated than today’s model, with significantly fewer players in the hedge fund management space. But while there was a degree of shrinkage in the aftermath of the financial crisis, there are signs that start-ups are recovering.

Perhaps the biggest change will be in terms of the size of funds, with big funds getting bigger and start-ups needing to be scaled up, but any further shrinkage is unlikely – particularly as the global economy recovers.

Emerging managers and large managers have big challenges on their hands with regards to delivering strong risk adjusted performance while at the same time delivering quality and confidence to their investors and the regulators via a world-class infrastructure. Although these types of managers will face different challenges in order to strike that balance, they should be more than capable of doing so.

Investor confidence

If hedge funds are to regain the confidence of investors that they enjoyed before the financial crisis, they will need to up their game in terms of trust and transparency. This means that hedge funds have to recognise that investors – particularly institutional investors – have their own stakeholders and their own environment. This involves aligning their own interests with those of their investors interests, and the key to this is to understand their needs.

There are signs that this type of strategy is beginning to pay dividends. A recent poll by Deutsche Bank showed that investors confidence in hedge funds is growing, with almost 60% of respondents set to increase their hedge fund allocations in 2014.

The end of redemption gates and suspensions?

During the financial crisis, many hedge funds enforced barriers to redemptions from investors, and in some cases even suspended redemptions in an effort to prevent catastrophic draw-downs. Naturally, this didn’t go down well with investors, who wanted to take back their money before it was all gone.

This experience has had a marked effect on the gating and suspending powers employed by start-ups, and while these contract provisions will always be there to a certain extent, this experience has proven that they are open to change. In particular, endowments and pension funds dont want their money tied up; they have to ensure that their income is matched to their liabilities. By showing that they are aware of this, they can help to build trust.

Investor concerns

There are three things that make investors worry about putting their money into a particular hedge fund: the risk of fraud; the risk that they may have made a poor choice with regard to strategy or managerial competence; and worries about the operational aspect of the HF industry. Of these, it is the risk of fraud that is of greatest concern to investors – particularly in light of high-profile frauds from the likes of Bernie Madoff and Peregrine Financial Group. However, the vast upswing in the scope and intensity of operational due diligence over the past four years could provide a solution to this concern.

Aside from this, he sees investors as being concerned about their return in terms of its reliability, and therefore want to look for less volatile investments.

Leverage – the root of the financial crisis?

With heavily-leveraged investments being blamed widely for the financial catastrophe of 2007/2008, the political pressure on the financial industry to change its ways has become acute. But while it is tempting just to blame leverage, its overuse was just one of the many root causes of the crisis, along with mortgage foreclosures and related problems.

Going forward, greater regulation should help to prevent some of the excesses that caused the crisis, and it has been embraced by managers through readiness assessments and increased compliance resources and infrastructure.

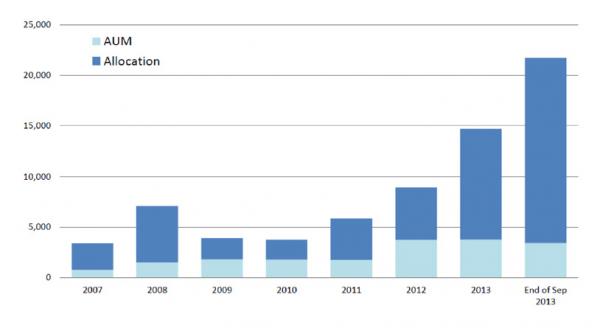

There are signs, in fact, that hedge funds are looking increasingly towards using leverage to boost returns. For example, in a letter to investors from Balyasny Asset Management in Q3 2013, the following bar chart was published, which showed a marked increase in the company’s use of leverage in the last couple of years – more than double the 2008 peak.

Algorithmic trading and HFT – a disaster waiting to happen?

One of the biggest changes in the financial industry over the past couple of decades has been the evolution of high-frequency trading and algorithmic strategies, which have made many investors anxious about the potential for unforeseen financial meltdowns at the hands of automated trading technologies responding to a freak set of circumstances.

However, much of the anxiety about HFT stems from its opaque ‘black box’ nature, and an appropriate level of transparency could help to relieve people’s fears about it.

In the book ‘Flash Boys: A Wall Street Revolt’, which was released in March 2014, author Michael Lewis alleged that markets are rigged in favour of high frequency traders who use their speed advantages to ‘legally front-run’ other investors. This intensified the spotlight on these practices, and shares in certain exchange operators (most notably Nasdaq OMX as well as CBOE Holdings and CME Group) and online brokers (TD Ameritrade and E*Trade Financial) took a nosedive as a result.

In the wake of the storm caused by the book, the US Attorney General said that the Justice department is investigating high-speed trading for insider trading, and other regulators and the FBI are also looking into similar issues. So, what we are likely to see is much tighter regulation surrounding HFT in future, although this may end up making the practice more acceptable to governments, citizens, and ultimately investors.

I am a writer based in London, specialising in finance, trading, investment, and forex. Aside from the articles and content I write for IntelligentHQ, I also write for euroinvestor.com, and I have also written educational trading and investment guides for various websites including tradingquarter.com. Before specialising in finance, I worked as a writer for various digital marketing firms, specialising in online SEO-friendly content. I grew up in Aberdeen, Scotland, and I have an MA in English Literature from the University of Glasgow and I am a lead musician in a band. You can find me on twitter @pmilne100.