Hedge funds have thrived as an industry in the recent years due to their attractive promise of high returns, favourable policies, sophisticated strategies and accurate techniques, and accessibility for the average investors. Some advantages of the hedge funds include:

- One of the most common attractions of hedge fund investments is that they have a tendency to reduce losses whilst generating high positive returns in both the rising and falling bond and equity markets.

- The aim of hedge fund managers is to consider the investments as risk in terms of capital loss and try to ensure that this does not happen. In contrast, traditional managers think about risk in terms of deviation from a benchmark. They will lose as the market does in tough times.

- Similarly, the hedge fund managers also invest their own capital into a hedge fund and their compensation is tied to the annual financial performance of the investment. This attracts only best managers to this industry.

- The hedge fund reduces the exposure to the general market movements and only targets the specific risks, which assures a constant stream of returns that has a low level of downside volatility as opposed to the general risk assets, such as equities. Hence, this diversification improves the returns on an investment.

- Studies have proven that hedge funds generate higher returns and a generally lower accompanying risk as opposed to traditional investment funds.

- Hedge funds are regarded as one of the best long-term investment solutions, thus eradicating the need to time entry and exit from the markets.

- Lastly, a large variety of hedge fund investment styles lead to a wide array of hedge fund strategies that can be implemented to meet any investment goals.

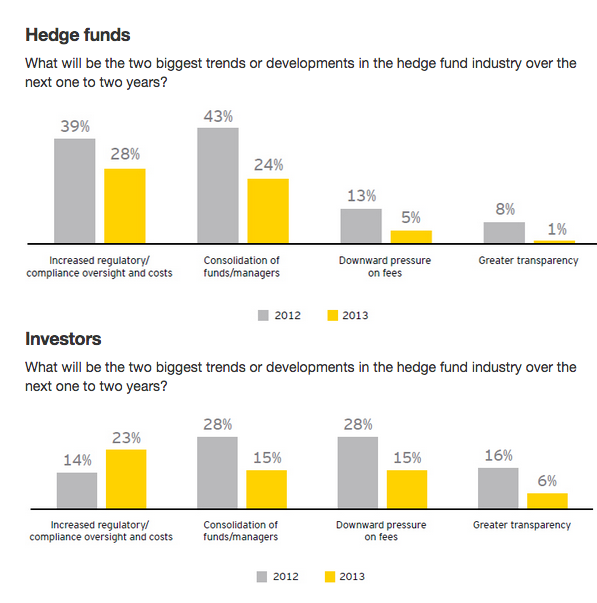

Below is the hedge funds trends between 2012 and 2013 prepared by Ernst & Young. It reveals that the biggest trend in 2013 was reduction in consolidation of funds/managers as well as in regulatory compliance oversight and costs.

Source: http://www.ey.com/GL/en/Industries/Financial-Services/Asset-Management/2013-global-hedge-fund-and-investor-survey—Future-trends

Hedge funds have progressed from their humble beginnings and some of the hedge fund trends of 2014 are:

- Out of all the hedge fund strategies, the equity long/short is the most popular strategy. Since 2008, 40 percent of the hedge industry assets were via long/short equity.

- A larger concentration of net flows has been going to a smaller proportion of managers with the most prominent brand names. Gone are the days when large and influential managers had control of most of the hedge fund assets. These small and mid-sized managers are able to raise such assets by offering a high quality fund, articulating the differential advantages among fund investors selection criteria and employing a high quality strategy that aids in deep market penetration.

- Many hedge funds will close to new interested investors. The trend of high concentration of assets that have been flowing to small managers, their optimum asset capacity has been surpassed to maximize the risk-adjusted returns.

- The average hedge fund fee would decline.

- There will be a marked decline in the hedge fund activity marketing activity in the European Union.

The hedge fund industry is still not as prominent as the equity and bond market industries, and this can be partially due to certain myths surrounding the hedge funds that people believe to be true. Some of the most common ones are:

- Hedge funds are solely for the rich and influential: This was a fact when hedge funds started out as they required a high minimum initial investment and were set up as private partnerships and were only open to a few investors. However, now because of the fund of funds and retail hedge funds, this is no longer true.

- Hedge funds are extra risky as compared to traditional investment: This is not entirely accurate as many active fund managers use hedging strategies to generate the highest possible risk-adjusted returns within a narrow band between seven to nine percent, by eliminating the general market risk.

- Hedge funds require exorbitant fees: Hedge fund fees include a performance fee and a smaller management fee. This may seem like a high percentage as compared to other securities, but one needs to focus on the high returns that hedge funds garner which makes these fees negligible. Furthermore, a performance fee for the managers ensures that they work in the best interest of the investors when creating hedging strategies.

Related Posts on Guide to Hedge Funds and Branding:

Guide to Hedge Funds and Branding – Part 3 Hedging and Investment strategies

Guide to Hedge Funds and Branding – Part 2 Introduction into Industry

Guide to Hedge Funds and Branding – Part 1 What is a Hedge Fund?

HedgeThink.com is the fund industry’s leading news, research and analysis source for individual and institutional accredited investors and professionals