Brexit and London Hegemony as a Fintech Global Capital

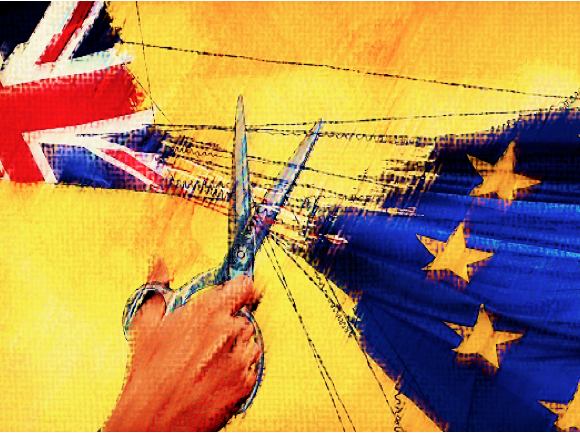

As the politic discussion around the Brexit continues very sensitive and to say less, polemic there is one fundamental question that is emerging: how much are the Brexit talks affecting London as a Fintech Powerhouse?

In the last 5 years London emerged as a Fintech and Technology world capital in part thanks to the efforts of the British government former PM David Cameron and chancellor George Osborne that named investor Eileen Burbidge a special envoy for FinTech earlier in 2015 to advise the Treasury and champion FinTech across the UK and internationally as part of his plans to boost the nation’s productivity. A lot of credit should be given also to Eric van der Kleij that was appointed to take charge of the enterprise in 2011 when former British Prime Minister David Cameron announced a plan to make the United Kingdom a global leader in number of technology startups, with the creation of Tech City, designed to compete with Silicon Valley.

Eric van der Kleij should also be credited with playing a pivotal role in creating and growing Level39 into becoming one of the most prominent accelerators in the European FinTech scene. And partly the force behing the London Fintech scene.

London until 2016 was fast becoming the top hub of innovation and technology, laying claim to the position as the fintech capital of the world, strengthening its place within the competitive global financial market. To put this into perspective, the UK is 2016 was the world fastest growing region for fintech investment with deal volumes growing at 74% per year since 2008, topping $265 million in 2013 alone (Accenture). That’s twice as fast as its American counterpart Silicon Valley and part because of its privilege location within a 500 million market with Europe and open passports for talent and circulation. The question is what is going to happen now that the Brexit is a big shadow over this sensitive and fast moving industry.

A recent report, FinTech – transforming finance, finds that the Brexit is having a powerful disruptive impact on the chances for London to continue leading the Fintech scene worldwide. The FinTech’s impact on finance and banking has proved to be as revolutionary to the sector as the internet has been for other areas of the economy. Yet the advantages offered to London’s FinTech sector through supportive regulation and geographical location could be off-set through loss of passporting rights and business uncertainty through the confusing long Brexit negotiations, and the tense politic divisions both in the UK government that are creating a strong and risky insecurity for the industry players and their international people, special European professionals and leaders that choose London as a footprint for operations.

Brexit challenge to London’s global FinTech boom, finds ACCA

The UK has positioned itself as a world-leading hub in emerging FinTech (financial technology) but the potential regulatory and business challenges posed by Brexit risks ceding ground to America and Asia Pacific rivals, says a new report from ACCA (the Association of Chartered Certified Accountants).

The report, FinTech – transforming finance, finds that FinTech’s impact on finance and banking is proving to be as revolutionary to the sector as the internet has been for other areas of the economy. Yet the advantages offered to London’s FinTech sector through supportive regulation and geographical location could be off-set through loss of passporting rights and business uncertainty through the Brexit negotiations.

Anthony Walters, ACCA’s head of policy for Western Europe, argues that until now the UK has provided a model of supporting and nurturing London’s FinTech sector,

‘In recent years there has been multi-billion investment in FinTech in the US, India and China. Yet despite the US benefitting from its economic strength and world-leading innovation centre in Silicon Valley, the implementation of FinTech’s potential has been slowed by regulatory hurdles.

In the UK, the Financial Conduct Authority has provided a model for regulation which has been conducive to nurturing innovative technologies. Combined with London’s unique geographical and infrastructural strengths as an international finance centre, as well as its status as leading global city, the UK has proven to be a highly attractive location for businesses, investors and innovators

Yet Anthony Walters warns that the potential impacts of Brexit could challenge London’s status,

The UK’s FinTech sector currently employs more than 66,000 people, with approximately a third coming from Europe. Inevitably the potential burdens of securing work permits for highly skilled individuals in a dynamic industry creates significant uncertainty, as does the regulatory headache which would be created by the loss of passporting rights for UK-based banks operating in the EU.

At the moment London’s strengths indicate it can be resilient to these issues, but the potential of FinTech to transform finance means that its future must be considered in any future negotiations

Overall Anthony Walters thinks that the rise of FinTech is good news for industry innovation and consumer choice;

‘While the scale of transformation is hard to predict, there is no doubt that the impact of FinTech across the traditional functions of finance has already been significant and there is much more to come. Major banking institutions are already responding through large-scale research and investment in the face of competition from start-up challengers.

‘This is good news for consumers and firms, as the explosion of choice in a traditionally conservative industry offers a range of new possibilities of doing business based around their bespoke needs.’

Yet Anthony Walters argues that the regulatory challenges posed by the speed of innovation places tough new demands on business operating in a fast-evolving, global landscape;

‘FinTech opens a range of possibilities for business, from new banks to streamlining payments and lending, yet exploiting these opportunities will require adaptation from firms as well. For instance, we are already seeing a rise of a blossoming ‘RegTech’ (Regulation Technology) sector which can use automation and data-analysis to provide intelligent, low-cost solutions to streamline this process.

Anthony Walters adds that it is professional accountants who will be best placed to navigate these obstacles;

‘While the rise of FinTech will reduce the labour time of much contemporary finance work, the fast-evolving nature of technology adoption will also necessitate transformations in tax compliance, audit and reporting processes

‘This will in fact place greater emphasis on the importance of having forward-thinking professional accountants equipped with a strong digital understanding and global vision to guide firms through the opportunities and challenges ahead.’

Understanding the intricacies of global best practices and adapting them for varying national contexts can set aspiring FinTech hubs on a course for success.’

You can read the report here: http://www.accaglobal.com/uk/