Overview

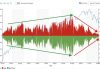

So far this summer the U.S. dollar has shown some broad based strength and is currently clinging to some gains made in the last week against most other majors. USD strength isnt because of love for the USD, but rather because of bad data elsewhere and the resulting implications around of the timing a Fed rate hike. The U.S. 2-year government bond has been relatively steady even as central banks show signs of policy divergence from their highly accommodative monetary stance, but biases are evolving in different directions. If you are confused, you are not alone. As Market News wrote, Anyone who claims to know what is going on is lying. Illustrating the very short sighted nature of most FX trading and commentary, Market News went on to point out, Price action [In the FX Market] is based on the latest flow and not necessarily on any well thought-out plan or strategy. I fully agree, and this is a topic that deserves much more discussion. Another time

Back to the US Dollar, in order for it to benefit in a more lasting way from the positive payrolls bombshell of last week, one thing needs to happen: the yield differential has to rise further to favor the dollar. According to Bloomberg, The extra yield that 10-year Treasuries offer over their Group-of-Seven counterparts expanded one basis point to 74 basis points, the most since April 2010. A good start, but this isnt enough. There needs to be an unmistakable and stable premium, possible as much as 1.5-2.5%, to underpin the dollar. This is not going to happen quickly, but it will happen as the Fed starts to move.

USA

The June payrolls increased 288,000 and May was revised up to 224,000. Both figures were more than forecast, and both were the best since 2006. U.S. job gains in the last 6-months are over 1.39 million.

The unemployment rate is down to 6.1%, the lowest since Sept 2008, which is a level the Fed had not expected until closer to year-end. This is all positive, even though the economy isnt producing high numbers of high quality jobs and the labor force participation rate is anemic. Nevertheless, the bottom line is that the accelerated rate of jobs buoys well for the economys strength.

Yesterday the Fed affirmed ending tapering in October and said Most participants viewed this as a technical issue with no substantive macroeconomic consequences and no consequences for the eventual decision about the timing of the first increase in the federal funds rate.

- Trade deficit fell 5.6% in May to $44.4 billion on a rise in exports to record highs and a drop in oil imports to the lowest since Nov 2010.

- Consumer Price Index rose 0.3% in April and 0.4% in May, taking yearly inflation to 2.1%.

- Retail sales increased 0.3% in May.

- Consumer spending was up 0.2% for May.

- Consumer sentiment was at 82.5 in June vs. an estimate of 82.

- Conference Boards consumer confidence index reached a 6-year peak in June at a reading of 85.2.

Russia / Emerging Markets

As the markets attention has turned to data, crises in the emerging market are off the tier 1 currency market radar.

The Ukrainian situation is now in a full-out civil war. Ukraine government has re-captured Slovyansk and the rebels are backing into the last big eastern stronghold of Donetsk. As we predicted, Russia is keeping its hand off, to the deep disappointment of the rebels Putin has yet to be heard from. Bloomberg reports Russias ruble gained 0.5 % against the dollar. Ukraines hryvnia strengthened 0.4%. Ukraines army has had the big-gest victories of a three-month campaign over the past few days, retaking the towns of Slovyansk and Kramatorsk.

- Russias PMI rose to 49.1

As tensions in Iraq have captured less western attention, the Central Bank of Turkey (CBT) cut the weekly repo rate (policy rate) by 75 basis points to 8.75% in June 24th. The overnight corridor remained unchanged at 8.00-12.00%. In the policy statement, the CBT mentioned its goal was to keep a flat yield curve until there be sizeable progress in the inflation outlook. The Turkeys inflation advanced to 9.66% in May with improvement foreseen from June. Given the tensions in Iraq and higher oil prices, do not rule out surprise deterioration in the TRY through the coming months. That said, the position below, which was highlighted on 6/17 commentary, currently has a 1.04 % net gain.

- Current USD/TRY rate is 2.1223.

- Mid implied volatility is 7.45%. Down over 2.0%.

Long TRY forward and Long USD Call/TRY Put, which is a long synthetic straddle. The structure benefits from a discount in the forward rate of the long TRY forward.

- Sell USD/TRY 1-Month forward at 2.1575 for (Get long TRY, which is at a 0.69 % discount to the spot rate).

- Buy 1-Month USD Call / TRY Put with 2.1428 Strike (54.60 Delta).

- Forwards implicit deposit rate is 8.23% annualized, or .69% per month.

- Yield from US dollar cash position 0.23%.

- Downside Breakeven (if the TRY appreciates) is USD/RUB 2.1326.

- Upside Breakeven (if the TRY depreciates) is USD/TRY 2.1825.

- Maximum Gain: Unlimited through TRY appreciation or depreciation vs. the USD.

- Maximum Downside: 1.17% of invested USD amount.

China

The US-China Strategic Dialogue opened today, although most everything has been discussed beforehand. The BOC raised the reference rate by 1 point and the yuan was engineered to a 3-month high. A series of weak numbers may open the window for stimulus, whether through directed programs or a rate cut/reserve cut. Government announced that a new agenda will include domestic financial reforms (Is that a hint?), and yuan reforms: Banks can apply their own renminbi rate to transactions according to supply and demand, although the official reference rate and 3% band will still apply to interbank trades.

- Exports rose 7.2% rise and 5.5% in imports, both less than expected.

- June CPI is up 2.3% y/y, which is less than forecast and down from 2.5% in May.

- PPI fell 1.1%, after -1.4% in May for the 28th month of decline.

- PMI index fell to 55.

- June manufacturing PMI rose to 51.

- Services PMI rose to 53.1 in June, the highest since March 2013.

- Composite PMI rose to 52.4 from 50.2 in May.

Euro (EUR)

The European Central Bank president said a program is in hand for 1 trillion euros ($1.4 trillion) for banks to build incentives to spur lending. The measure will allow banks to borrow cheaply from the ECB even without increasing credit supply. The EUR has corrected from lows in June to reached highs in July. Regardless of data or proposals, the EURs downward trend may be coming to an end. However, if worries about Draghis dovishness and the effectiveness of his institutional proposals may grow, the EUR will fall back again. Implied volatility is extremely low. Exercise caution writing options.

Due to a delay in some bond payments by a Spanish bank, Espiritu Santo, peripheral European yields have risen. The resulting change in sentiment took the Italian and Spanish 10-year yields to 2.84% (up 3 bps) to 2.71% (3 bps) respectively. Note: the German Bunds are unchanged at 1.25%.

Eurozone

- June inflation fell to -1.5% from -2.1% in May.

- Eurozone July investor confidence firmed to 10.1.

- Eurozone May retail sales were flat from the prior month.

- Investor sentiment rose to 10.1 in July from 8.5, which is better than expected.

- Current situation sentiment rose to 2.3 from 0.3 June.

- 6-month for sentiment expectations are at 18.3 from 17 in June.

- May PPI fell by 0.1% m/m and dropped 1% y/y.

- June CPI was steady at 0.5% y/y.

- Core CPI firmed to 0.8% y/y.

- May M3 money growth firmed to 1% y/y

- Eurozone retail sales posted a no change in May over April; however April was revised to -0.2%.

- Eurozone final composite PMI was the same as the flash at 52.8 (down from 53.2 in May)

Germany

- Semi-final against Brazil made history with a 7-1 blow-out.

- May current account surplus narrowed to 13.2B.

- Exports fell 1.1% m/m.

- May industrial output unexpectedly declined 1.8% m/m

- May retail sales fell 0.6% m/m

- Final composite fell to 54 from the flash at 54.2 in May.

France

Industrial production and CPI figures suggest that the governments annual 1% in GDP forecasts looks is unlikely.

- Bank of France business sentiment was steady at 97

- Industrial production dripped 1.7% m/m in May.

- CPI is up 0.6% y/y in June. 0.8% was forecast, and the June is the lowest since Nov.

Portugal, Ireland, Greece, Spain and Netherlands too

- Italian industrial output fell 1.2% when a rise by 0.2% was forecast.

- Netherlands industrial production dropped 1.9% (vs. a forecast of a 0.3% rise).

- Deflation decreased in Greece, with inflation at -1.1% from -2%. It was -2.9% in November.

- Spains 10-year yield rose 4 bp 2.76%.

- Greece jumped 11 bp to 6.13%, and Italy, up 5 bp to 2.89%.

- Portugals 10 year jumped 19 bp to 3.84%.

- Current EUR/USD rate is 1.3598. Up since last commentary.

- Mid implied volatility is 4.54%.

- Current EUR/JPY rate is 137.80

- Mid implied volatility is 4.98%.

Recommended Enhanced Yield structure: Buy EUR forward.

- Long EUR/USD forward at 1.3599 for 2-Weeks.

- Sell 3-Week EUR Call/ USD Put with 136.30 Strike (40 Delta).

- Forwards implicit deposit rate is -0.01%.

- Yield from US dollar cash position 0.23%.

- Yield from option premium is 5.16% annualized.

- Structures yield is 5.38% (from forward deposit rate, U.S. deposit rate, and options premium), plus potential capital gain from EUR appreciation to 136.30.

Australian dollar (AUD)

After the release of some soft trade data, the Australian dollar weakened among the major currencies. The central bank repeated that a high Australian dollar offers less assistance to balancing growth, while noting that growth is expected to be a little below trend in the year ahead. RBA Gov Stevens called the AUD overvalued by most measures. Nevertheless, technicals point to continue short term AUD strength.

- July consumer confidence index firmed to 94.9.

- June business conditions improved to +2.

- July business confidence firmed to +7.

- May retail sales fell 0.5% m/m.

- Building approvals rose 9.9% m/m.

- PMI index fell to 47.6.

- May trade deficit widened to A$1.91B.

- Reserve Bank held its Cash Rate at 2.50% and reiterated a neutral interest rate bias.

- May private sector credit firmed to 4.7% y/y

- Current AUD/USD rate is 0.9387. Slightly lower since last commentary.

- Mid implied volatility is 5.53%.

Recommended Enhanced Yield structure: Long AUD forward.

- Long AUD/USD forward at 0.9380 for 2-Weeks.

- Sell 2-Week AUD Call / USD Put with 0.9430 Strike (39 Delta).

- Forwards implicit deposit rate is 1.82%.

- Yield from US dollar cash position 0.23%.

- Yield from option 5.12% annualized.

- Structures yield is 7.17% annualized (from forward deposit rate, U.S. deposit rate, and options premium) plus potential capital gain from AUD appreciation to 0.9430.

Great British Pound (GBP)

The pound is mildly higher after continued releases of sturdy data. Growth and labor market strength continue to improve, and although there has been some softening in the sentiment surveys, they have remained strong. A rapid deceleration in the housing market would pose a risk, but it doesnt seem likely as prices have eased but are still up 8.8% in Q2. BOE appear to have become more hawkish. Policy discussions around timing of hikes. Technicals show GBP testing resistance.

- May goods trade deficit rose to £9.2 b from £8.8 in April, more than forecast.

- House prices fell in 0.6% June but still got a rise of 8.8% in Q2, the biggest gain since 2007.

- BRC (British Retail Consortium) shop price report shows the biggest drop in 8 years, 1.8% y/y in June after 1.4% in May.

- Non-food prices fell 3.4%.

- Manufacturing down 1.3% in May when +0.4% was forecast and the first decline in 6 months.

- Output grew 3.7% y/y in May from 4.3% in April, which isnt bad.

- May industrial output fell 0.7% m/m.

- June Nationwide house prices firmed to 1% m/m.

- June construction PMI unexpectedly rose to 62.6.

- Service sector PMI dipped to 57.7 in June from 58.6 in May but remains solidly above 50.

- May mortgage lending rose by £2.0B .

- Consumer credit rose by £0.7B.

- Current GBP/USD rate is 1.7132, which is up from 1.6940 in last commentary.

- Mid implied volatility is 4.91%.

Recommended Enhanced Yield structure: Buy GBP Forward

- Long GBP/USD forward at 1.7133 for 3-Weeks.

- Sell 3-Week GBP Call/ USD Put with 1.7230 Strike (31 Delta).

- Forwards implicit deposit rate is 0.00%.

- Yield from US dollar cash position 0.23%.

- Yield from option premium is 4.05% annualized.

- Structures yield is 4.28% annualized (from forward deposit rate, U.S. deposit rate, and options premium), plus potential capital gain from GBP appreciate to 1.7230.

Canadian Dollar (CAD)

The central bank remains concerned about low inflation amid weaker-than expect growth. Where have we heard this before? Strength in the U.S. economy should support Canada and benign, or brushed aside, geopolitical concerns are positive for the commodity currencies. With inflation near the Bank of Canadas near term target rate and a robust housing market, the likelihood of greater dovishness from the central bank is limited. Additionally, technicals are slightly positive. Expect very moderate CAD strength. Implied volatility is slightly higher.

- June housing starts rose to 198,200, slightly above expectations

- May building permits jumped by 13.8% m/m.

- Unemployment rate ticked up to 7.0%.

- Nominal retail sales rose 1.1% in April, which is stronger than-expected

- April 2014 GDP rose by a weaker than expected 0.1% in the month

- Housing starts unexpectedly increased by 0.6%.(This may in part be because I built 3 walls in one house with Habitat for Humanity)

- Service-producing industries rose by 0.3%

- May trade deficit narrowed to C$150M.

- Canadian PMI rose to 53.5 from 52.2 in May.

- USD/CAD rate is 1.0657, which is lower than 1.0850 in the last commentary, meaning that the CAD strengthened.

- Mid implied volatility is 4.53%.

Recommended Enhanced Yield structure: Long CAD forward

- Short USD/CAD forward at 1.0659 for 2-Weeks.

- Sell 2-Week USD Put / CAD Call with 1.0630 Strike (41 Delta).

- Forwards implicit deposit rate is -0.50%.

- Yield from US dollar cash position 0.24%.

- Yield from option premium is 5.61% annualized.

- Structures yield is 5.35% annualized (from forward deposit rate, U.S. deposit rate, and options premium), plus potential capital gain from CAD appreciation to 1.0630.

Japanese Yen (JPY)

Core machinery orders (a leading indicator) tanked 19.5, which is the worst 1-month drop since in 1987. Considering all weve seen in Japan since 1987, the speaks volumes. Some are worried about the role of the sales tax hike and the credibility of Abenomics. Oddly, it was the JPY that rallied on the news.

- Core machinery orders dropped by 19.5%!

- Japans June machine tool orders rose 34.2% y/y

- May current account surplus widened to ¥384.6B in May

- June economy watchers survey rose to 47.7

- May leading index eased to 105

- May domestic corporate goods prices firmed to 4.4% y/y.

- Japans PMI index rose to 49

- 1.Japans May industrial output rose 0.5% m/m and

- June small business confidence rose to 47.3

- Current USD/JPY rate is 101.23.

- Mid implied volatility 4.93%.

- Current EUR/JPY rate is 1.3778.

- Mid implied volatility is 4.98%.

No Position Recommended. Implied volatility is too low to justify risk.

Mexican Peso (MXN)

Monetary policy should remain on hold for now, while successful implementation of structural reforms should result in increased economic activity. Speculative FX positioning shows an increase in peso longs, while the technical outlook is mixed. The central bank gave the economy another dose of stimulus by cutting the policy rate to a record low after a sluggish start to the year. Look for a recovery and gradual strengthening in the peso.

- Inflation rate up to 3.75% from 3.51 in May.

- Trade surplus narrowed for second consecutive month to USD 132M, which is a 4-Month low.

- Unemployment rate rose to 4.92%.

- June CPI firmed to 3.8% y/y.

- May leading indicators firmed 0.11% m/m.

- Current USD/MXN rate is 12.9910, which is higher than the 12.9867 rate from the last commentary, meaning that the MXN weakened vs. the USD. Our sole directional loser, but still a P&L winner!

- Mid implied volatility is 6.12%.

Recommended Enhanced Yield structure: Long MXN forward

- Short USD/MXN position established from exercise of 12.9500 Strike USD Call / MXN Put.

- Swap spot position into 2-week forward.

- Sell 2-Week USD Put / MXN Call with 12.9250 Strike (37.5 Delta).

- Forwards implicit deposit rate is 0.12%.

- Yield from US dollar cash position 0.23%.

- Yield from option premium is 4.00% annualized.

- Structures yield is 4.35% annualized (from forward deposit rate, U.S. deposit rate, and options premium), plus potential capital gain from MXN appreciation to 12.925.

Mr. Huddleston has nearly 20 years of financial services experience, with primary expertise in the conceptual and structural development and trading of derivatives. He has also held a range of senior advisory positions working with high net worth and institutional clients, with his most recent role at Wells Fargo focused on the development of customized foreign exchange derivatives for the firm’s ultra high net worth clients. Mr. Huddleston has also held a range of management and trading positions at Capital Markets Trading (Frankfurt), Dresdner Bank (Frankfurt) and Citibank (Frankfurt and Hong Kong). Mr. Huddleston was a member of the Pacific Stock Exchange, where he was an options market maker on Microsoft listed stock options.